Articles by Harriet Matthews

VR Equitypartner invests in Aku

GP has acquired a minority stake in the industrial image processing technology business

ND Industrial Investments acquires EGo Mobile

Electric car producer was valued at €1bn prior to its self-administration filing in April 2020

SwanCap holds final close for Swan IV

Co-investment fund closed on €303m, surpassing its €250m target, and the GP has now launched Swan V

Silverfleet hires Prym as investment executive

Stephan Prym joins from Aplina Partners, marking Silverfleet's second DACH hire of 2020

Munich Private Equity Partners launches fundraising for MPEP IV

Fund targets €250m and is open to third-party investors following a €100m commitment from RWB Group

VC-backed IDNow acquires Wirecard Communication Services

IDNow intends to expand its customer service offering following increased demand in recent months

EQT Infrastructure in exclusivity to acquire IK's Colisée

During IK's three-year holding period, the company tripled in size, according to a statement

Pinova Capital invests in AT Automation Technology

Deal is the sixth from Pinova Fund II, which held a final close in January 2017 on €180m

GP Profile: Egeria

Hannes Rumer, a partner in Egeria's new Munich office, discusses the GP’s strategy and deal pipeline for the DACH region

Mentha Capital acquires Rapid Circle

Deal is the GP's second of 2020, following its sale of Ardena to GHO Capital Partners in January

Patrimonium and co-investors sell Fixatti to trade

MBO of Schaetti Group took place in 2013; the company was rebranded as Fixatti in 2018

Consortium backs €4.6m round for Neon

New investors in the Swiss banking startup were Helvetia Venture Fund and e-commerce company QoQa

Maguar Capital and co-investors acquire HRWorks

Aberdeen Standard Investments, EMZ Partners, Golding and LFPE are also backing Maguar's debut deal

CE Capital acquires Walter Hundhausen

Iron castings manufacturer filed for insolvency in May 2020, as did its parent company GMH Guss

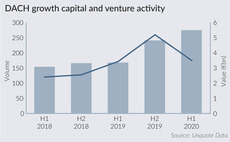

DACH holds up under pandemic pressure, but recovery doubts remain

Market players suggest it is unlikely that H1 figures reflect the extent of the damage done to portfolios and M&A

DBAG acquires Congatec

MBO of the computing and robotic components producer is the second deal from DBAG Fund VIII

Waterland's Beck Et Al buys InfoWan

IT cloud service group now comprises four businesses and was formed by Waterland in May 2020

CVC's Syntegon sells Viersen-based operations to trade

CVC acquired Syntegon Technolgy in a carve-out from Robert Bosch in 2019 via its seventh fund

Adiuva-backed Konzmann acquires Trenker

Building services provider has made 12 add-ons since Adiuva Capital first invested in 2016

DACH venture and growth deals reach volume high in H1 2020

Growth and VC deal volume exceeded that of all previous half-yearly figures, although average deal size and fundraising activity declined

Ceecat Capital on road for Fund II

Vehicle is the first to be raised since Ceecat Capital span out from ADM Capital in 2018

Gilde's Raak Metals buys Stolwerk Metaal

Add-on is the first since GIlde Equity Management bought a majority stake in Raak in February 2020

LDC's Onecom bolts on Glamorgan Telecom Group

Add-on is the first since LDC and Ares provided financing of £100m to the telecoms company in 2019

Deutsche Beteiligungs AG acquires Multimon

Acquisition of the fire safety systems provider is the first from the GP's €1.1bn eighth fund