Articles by Harriet Matthews

Hg's MeinAuto sets IPO price range

Shares are each priced in the €16-20 range, corresponding to a €1.2-1.5bn market capitalisation

Gyrus holds close for Gyrus Investment Program

Program comprises Gyrus Principal Fund and its co-investment Cortex fund; it has a тЌ400m hard-cap

Hannover Finanz, Arcus acquire Löwenstark

Mittelstand-focused GPs aim to support the online marketing firm's growth and succession planning

Gimv buys minority stake in Projective Group

Digitalisation consultancy and recruitment business intends to pursue a buy-and-build strategy

VC-backed Darktrace lists on LSE

Cybersecurity platform has a market cap of around ТЃ1.7bn; it raised its first funding round in 2013

Paragon-backed Apontis Pharma sets IPO price range

Shares are priced at €18.5-24.5, with a final pricing expected on 6 May before the 11 May listing

Ares closes Ares Capital Europe V on €11bn

Ace V is Ares' largest institutional fund yet and is 70% larger than its тЌ6.5bn predecessor

Permira buys minority stake in New Immo Group

Existing investor Qualium Investissement is to retain a stake in the digital real estate platform

VCs in $75m round for Kaia Health

Digital physical therapy platform is backed by all existing investors, including Balderton Capital

Endeit Capital holds final close for third fund on €250m

Fund II closed on тЌ125m in 2016; Fund III will continue to invest scale-up capital in European startups

Corten buys Emeram's Matrix42

SBO of the digital workspace software is Corten's first investment from its €392m debut fund

Gilde Healthcare buys Acti-Med

Deal is the fourth platform investment from the GP's €200m Gilde Healthcare Services III fund

Capiton, Nord Holding sell Engelmann Sensor to DPE

Smart meter business is the final portfolio company in Capiton's 2010-vintage fourth fund

Telemos Capital acquires Mammut

Conzzeta began to explore sale options for the Swiss outdoor clothing and hardware brand in 2019

Aurelius announces UK team appointments

Simon Jobson joins the London team as a principal; Shivani Sheth joins as an investment associate

Maguar Capital invests in Bregal-backed STP

Maguar partner Gunther Thies founded STP; partner Arno Poschik was on STP's board during his time at Hg

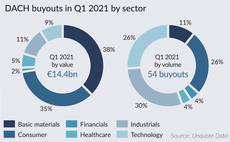

Appetite for DACH tech deals continues apace in Q1

Sponsor demand for differentiated IT services and roll-up strategies remains consistent

KKR sells minority stake in Hensoldt

Leonardo is to buy the 25.1% stake for €606m; KKR will retain an 18% stake in the sensor developer

EQT's Suse sets out IPO plans

Enterprise software platform intends to generate net proceeds of $500m with its Q2 2021 IPO

Inflexion and Informa combine FBX, Novantas

Inflexion and Novantas will each own a minority stake in the newly formed financial data business

Egeria acquires NIBC-backed Fletcher Hotels

NIBC backed Fletcher's 2016 MBO; Fletcher plans to grow from 103 to 150 hotels in the coming years

Finexx buys Volpini Verpackungen

GP also announces it has increased the volume of its Finexx II fund to €30m

DACH buyouts continue recovery from Q2 2020 low

Both deal volume and value are now back on par with the figures for Q4 2019, prior to the pandemic

Paragon acquires Bregal's Sovendus

Bregal acquired a minority stake in the e-commerce customer reward platform in 2015