Articles by Francesca Veronesi

The Carlyle Group buys LPG Systems

Europe and Asia-focused funds deployed to back France-based LPG, in view of Asian expansion

BNP Paribas, BPI France back BEG Ingénierie MBO

Six managers join the capital structure of French real estate construction company BEG

Eurazeo et al. sell PeopleDoc to trade

US-listed Ultimate Software buys France-based PeopleDoc, a cloud-based HR delivery system

CDC International, Mubadala back SFAM

Franco-emirati Fund (FEF), jointly-owned by CDC and Mubadala, was used for the transaction

BlackFin holds €180m final close for tech fund

Having held a first close a year ago, BlackFin Tech Fund 1 surpasses €150m target

Avedon sells Robidus to trade

During Avedon's three-year ownership, social security service Robidus doubled its revenues

Eurazeo sells Odealim to TA

Sale of insurance brokerage firm Odealim is expected to generate a money multiple of around 2x

Cathay holds €600m first close for Midcap II

Vehicle will provide equity tickets of up to €100m and up to €150m with co-investment

BC Partners' MCS Group bolts-on DSO

Debt management service MCS Group, backed by BC Partners since 2017, buys peer DSO Group

Corpfin buys Grupo Barna

Grupo Barna plans to make an acquisition and commence its international expansion plans

BPI France launches InnoBio 2

BPI France and France-based corporate Sanofi have already made commitments to the vehicle

Abry Partners sells Basefarm to trade

PE-backed Norwegian IT services company Basefarm is acquired by France-based corporate Orange

Holland Venture backs MedAngel

GP invests alongside the fund manager of the province of Gelderland's innovation fund

Platina buys Cap Vital Sante

France-based Cap Vital Sante was previously owned by the founder and members of the network

Active Capital's FTNon sold to trade for €32m

US-based JBT Corporation acquires Dutch FTNon, the industrial food equipment provider

Pechel backs Vernicolor

Pechel buys a minority, while founding CEO François Champier and management retain the remainder

Alven, Idinvest inject $45m into Meero

After a funding round in Q4 2017, commercial photography specialist Meero attracts new capital

Amundi Private Equity backs Appart Fitness

France-based gym operator will bolt on its peer Nextalis following the capital injection

CM-CIC et al. inject €53.5m in Socomore

CM-CIC and Ace recommit to France-based Socomore, Raise and BPI France are new backers

Societe Generale Capital Partenaires backs Netcom

Three founders retain their majority stake in the France-based telecommunications operator

Demeter backs Piscines Magiline in MBO

UI Gestion, BPI France, Esfin Gestion and BTP Capital remain backers of Piscines Magiline

Gilde Equity Management acquires Eiffel

Transaction sees founder Ferdi van Dommelen exit his investment in the Dutch consultancy

Quilvest reshuffles management

Alexis Meffre takes over from Stanislas Poniatowski as Quilvest's executive chairperson

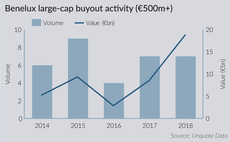

Benelux large-cap activity swells in H1

Aggregate value of deals valued at more than €500m is approaching pre-crisis levels, based on H1 2018 figures