Articles by Francesca Veronesi

LBO France et al. back Deezer

Consortium of investors injects €160m in France-based music streaming service Deezer

Charterhouse acquires Funecap

Management equally reinvests in funeral service Funecap, which posts an EBITDA of around €40m

HIG's Valtris bolts-on Ineos divisions

Valtris buys France-based Ineos Baleycourt and Benelux-based Ineos ChloroToluenes

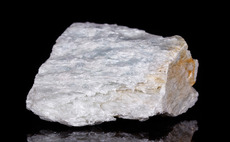

Elementis puts sale of Mondo Minerals to Advent on hold

Advent announced the sale of Mondo to listed Elementis in June, with EV amounting to $600m

Main Mezzanine Capital holds first close for maiden fund

Mezzanine division of Main Capital first started investing via a €50m capital pool

Ardian's Trigo bolts-on SCSI

SCSI represents the sixth acquisition since Ardian bought France-based Trigo in 2016

Advent rejects offers for Unit4

Netherlands-based software developer Unit4 was acquired by Advent for €1.17bn in 2014

Chequers, IGI PE sell Rollon Group to trade

Business was first backed by PE houses in 2010, when Ardian took a 51.8% stake at a €48.9m EV

Tikehau holds first close, launches fund

French GP's TGE II backs SMEs across western Europe with EBITDA in the €5-50m range

Endless-backed Brabant Alucast files for bankruptcy

Dutch car component manufacturer was bought by Endless via Endless Fund IV in 2016

CapDecisif holds first close for CapDecisif 4

VC is aiming to exceed its €50m target but will not surpass the €70m assigned hard-cap

BPI France sells CPI to trade

French book printing group CPI is bought by Netherlands-based Circle Media Group

Argos Wityu buys Juratoys in MBO

Juratoys was previously owned by US-headquartered Alex Brands, backed by Propel Equity

CVC sells Linxens to trade in $2.6bn deal

France-based smartcard parts maker Linxens is sold to Chinese conglomerate Unisplendour

BPI France, Latour buy Plastic Omnium Environment

Latour Capital is currently investing via its Latour Capital II vehicle that closed on €306m

Naxicap's SushiShop sold to trade for €240m

Poland-based restaurant group AmRest acquires the France-based Japanese restaurant in a €240m deal

5Square backs My Micro Group

5Square, business angels and founders invest in online electronics wholesaler My Micro Group

Initiative & Finance invests in Proferm

GP buys a minority stake in French carpentry specialist Proferm, CEO Dejonghe retains majority

Ekkio buys Calicéo

GP invests alongside management, while founding family Ponteins sells stake in Caliceo

Waterland buys Within Reach Group

Including the latest acquisitions, WRG expects total annual turnover of €75m in 2018

PAI Partners to acquire Asmodee in €1.2bn deal

investment in Asmodee generated 4x money multiple for Eurazeo and yielded 35% IRR

Momentum Invest holds €101m interim close for maiden fund

Momentum Invest I, targeting France-based and services-focused SMEs, exceeds €100m target

Andera holds €360m first close for Winch Capital 4

Andera's fourth generation SMEs fund is well positioned to hit its €400m hard-cap in Q3 2018

Andera buys Skill & You in SBO

Skill & You investment is the first transaction from the mid-cap vehicle Winch Capital