Buyouts

HgCapital buys e-conomic

HgCapital has acquired e-conomic, a Denmark-based software-as-a-service (SaaS) accounting business for SMEs.

Bregal buys Ideal Stelrad despite RBS backlash

Bregal Capital has acquired boiler and radiator company Ideal Stelrad, despite attempts by RBS to block the ТЃ230m deal.

Star Capital sells Alloheim to Carlyle for €180m

Star Capital has sold Alloheim Senioren-Residenzen, a provider of residential care for elderly people in Germany, to fellow private equity house Carlyle for €180m.

Bregal buys proAlpha from Beaufort Capital

Bregal Capital has bought a majority stake in excess of 70% in proAlpha, a manufacturer of enterprise-resource-planning (ERP) software.

Triton buys Alpine-Energie

Triton has wholly acquired Austrian energy firm Alpine-Energie Holding from Spanish group Fomento de Construcciones y Contratas (FCC).

CVC acquires Domestic & General from Advent

CVC has agreed to buy insurance business Domestic & General (D&G) from Advent International, alongside management.

CVC set to buy Campbell Europe

CVC Capital Partners has entered exclusive negotiations with Campbell Soup Company to acquire part of its European activities.

LDC backs MBO of uSwitch.com

LDC has acquired a significant stake in uSwitch.com, a UK-based price comparison site, as part of a management buyout.

Whitworths set for tertiary deal

Food company Whitworths looks set to fall into the hands of a third private equity owner as current backer European Capital seeks an exit.

Main Capital acquires Regas

Main Capital Partners has acquired a majority stake in Regas, a Dutch software-as-a-service (SaaS) provider for the mental health and wellbeing industry, via its Main Capital III fund.

MCH sells Industrias el Gamo in secondary buyout

MCH Private Equity has sold airgun manufacturer Industrias el Gamo to US private equity house Bruckmann, Rosser, Sherrill & Co.

Lyceum acquires Johnson's FM division for £32.2m

Lyceum Capital has acquired the facilities management (FM) division of AIM-listed Johnson Service Group for ТЃ32.2m.

Ex-Premier Foods boss to advise KKR on Lucozade and Ribena bid

KKR is understood to have brought in Michael Clarke, the former CEO of Premier Foods, to advise on its ТЃ1.5bn bid for Lucozade and Ribena from GlaxoSmithKline (GSK).

Insuring deals: another layer of fees or vital protection?

Insuring deals

Nord Holding buys Jumpers Group

Nord Holding has bought a 65% stake in German fitness chain Jumpers Group.

Isis invests £9m in Key Travel MBO

Isis Equity Partners has invested ТЃ9m as part of a management buyout for travel management company Key Travel.

Equita sells Karl Eugen Fischer to Equistone

Equita has sold its majority stake in Karl Eugen Fischer (KEF), a German provider of cutting systems for tyres, to fellow private equity house Equistone Partners Europe.

Piper acquires Orlebar Brown

Consumer brands investor Piper has acquired a majority stake in luxury menswear clothing company Orlebar Brown.

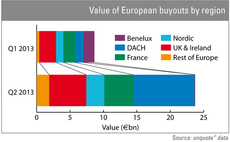

Germany shifts into overdrive in Q2

A string of mega-buyouts helped Germany secure the top spot on European buyout value tables in the second quarter of this year.

Theo Fennell board recommends EME offer

EME Capital has finally had its offer for AIM-listed high-end jewellery company Theo Fennell recommended by the board.

Pamplona to leverage OGF purchase with €635m debt package

The recently announced buyout of French funeral services operator OGF by Pamplona will be financed by a €635m debt package, according to media reports.

Investcorp buys snack manufacturer Tyrrells for £100m

Investcorp has acquired Tyrrells Potato Crisps, a UK-based manufacturer of crisps and snacks, from Langholm Capital for ТЃ100m.

Synova acquires Mandata

Synova Capital has acquired Mandata, a provider of software-as-a-service (SaaS) to the haulage and logistics market in the UK.

Equistone indulges with Charles & Alice

Equistone Partners Europe has invested in French fruit dessert maker Charles & Alice Group, alongside existing investor CM-CIC Capital Finance.