Buyouts

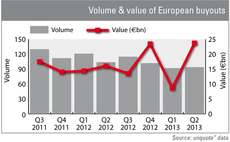

Q2: overall buyout value soars by 174%

The European buyout market recovered spectacularly in value terms in Q2 on the back of a string of mega-deals, but the overall volume of activity remains lacklustre.

Activa buys majority stake in listed Nexeya

Activa Capital has acquired a 57.9% stake in NYSE Euronext-listed Nexeya, alongside BPI France Investissement, and launched an offer for the remainder of the shares.

Darwin PE backs £11m Esendex MBO

Darwin Private Equity has acquired UK-based Esendex, a provider of short message service (SMS) solutions for businesses, in an ТЃ11m management buyout led by the companyтs newly-promoted CEO.

IK acquires Ampelmann

IK Investment Partners has bought a majority stake in Netherlands-based Ampelmann, a provider of motion technology systems and structures for the offshore energy sector.

Pamplona set to buy OGF from Astorg

Pamplona Capital Management is set to acquire French funeral services provider OGF from Astorg Partners, a deal reportedly valued at around €900m.

Mobeus supports Veritek MBO

Mobeus Equity Partners has backed the ТЃ11m management buyout of Veritek Global, a provider of technical services.

Graphite tucks into Hawksmoor

Graphite Capital has succeeded in its bid to acquire Hawksmoor, supporting the high-end steak restaurant group's management buyout.

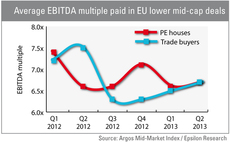

Mid-cap valuations remain stable as dealflow stagnates

Mid-cap valuations

Qualium backs Mériguet group

Qualium Investissement has invested in the owner buyout (OBO) of the Atelier Mériguet-Carrère group, a Paris-based arts specialist and renovator.

BlackFin buys DevisMutuelle and KelAssur

BlackFin Capital Partners has acquired insurance comparison sites DevisMutuelle and KelAssur.

HgCapital buys majority stake in IntelliFlo

HgCapital has acquired a majority stake in software company IntelliFlo via its Mercury Fund.

Mosaic et al. invest in Woodall Nicholson

Mosaic Private Equity, RooGreen Ventures and Enterprise Ventures have invested in Woodall Nicholson Group, a UK coach-building business.

Altor and Bain acquire Ewos for NOK 6.5bn

Norwegian state owned-Cermaq has sold its Ewos division to Altor and Bain Capital for NOK 6.5bn.

Gimv and Bencis pinch Punch's Xeikon

Gimv and Bencis Capital Partners have acquired a stake in listed Dutch printing business Xeikon from parent company Punch International.

Cinven backs Host Europe

Cinven has agreed to acquire internet domain and hosting company Host Europe Group from Montagu Private Equity for ТЃ438m.

Bain picks up state-owned Plasma Resources UK for £230m

Bain Capital has acquired an 80% stake in government-owned Plasma Resources UK (PRUK) for ТЃ230m.

Battery Ventures buys IHS from Kings Park Capital

Kings Park Capital has exited German marketing company IHS to a newco backed by Battery Ventures, reaping a 3.8x gross money multiple.

Electra reinvests in Allflex as sale completes

Following the completion of the sale to BC Partners, Electra Private Equity has reinvested £57m in animal tags manufacturer Allflex in exchange for a 15% stake.

AnaCap backs Simply Business MBO

AnaCap Financial Partners has backed the ТЃ50m management buyout of Simply Business, a UK insurance provider to small businesses.

UK Watch: Q2 shows signs of recovery

UK rebounds in Q2

Axa PE given green light for Club Med takeover

French regulatory body AMF has authorised Axa Private Equity and Fosun's joint bid for listed French holiday resorts group Club Méditerranée.

Cinven's EnServe sells Inenco to Vitruvian and ICG

Vitruvian Partners and Intermediate Capital Group (ICG) have acquired energy and utility outsourcing business Inenco Group from Cinven-backed EnServe Group.

Elior sale back on track, Axa PE in lead

Axa Private Equity and Caisse de Dépôt et Placement du Québec (CDPQ) have made a revised joint bid for Charterhouse's French catering business Elior, according to reports in the local press.

Omnes backs Eratome SBO

Omnes Capital has made a €15m capital injection into French refurbishment and construction firm Eratome, buying the asset from CM-CIC Capital Privé.