Buyouts

Siparex acquires Grontmij division for €71m

Private equity firm Siparex has acquired CEBTP, the French monitoring and testing business of Grontmij, for €71m.

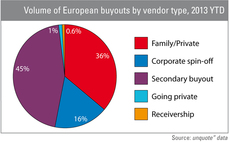

"Pass-the-parcel" deals creep up in H1

Secondary buyouts have accounted for 45% of the overall number of buyouts in the first half of 2013, the highest proportion witnessed since the onset of the financial crisis, according to unquote" data.

Isis invests £18m in YSC buyout

Isis Equity Partners has invested ТЃ18m in the ТЃ38m MBO of YSC, a global business psychology firm.

Foresight backs Aerospace Tooling BIMBO

Foresight has invested ТЃ3.5m in the buy-in management buyout (BIMBO) of Scottish precision engineering company Aerospace Tooling.

Altor acquires Rossignol

Altor Equity Partners has agreed to acquire a majority stake in French ski equipment company Rossignol Group.

Accent Equity acquires Infolog

Accent Equity Partners has acquired Infolog, a division of Swedish business communication group Intellecta.

EdRip backs DufyElec in SBO

Edmond de Rothschild Investment Partners (EdRip) has acquired a minority stake in DufyElec from the company’s private equity owner Naxicap Partners.

Permira casts its net for Ewos

Permira has joined Bain Capital and Altor in the bidding war for Norwegian fish farmer Cermaqтs fish feed division Ewos.

Qualium et al. buy Invicta in MBI

Qualium Investissement has acquired a majority stake in the management buy-in of French wood-based heating devices manufacturer Invicta.

Metric acquires Danish lingerie chain

Metric Capital Partners (MCP) has bought a qualified minority stake in Copenhagen-based retail firm Change of Scandinavia, in a deal that values the business at around тЌ70m.

Argos Soditic buys Via Delle Perle

Argos Soditic has acquired a majority stake in womenswear firm Via Delle Perle.

NVM backs Buoyant MBO

NVM Private Equity has supported the management buyout of British upholstering manufacturer Buoyant Holding with a ТЃ7m equity ticket.

Accent acquires Steni from Total Capital

Accent Equity Partners has wholly acquired Norwegian faУЇade panel company Steni from Total Capital Partners.

FSN Capital acquires Validus

FSN Capital has acquired a majority stake in Norwegian retail holding company Validus from founder Terje Stykket and Norgesgruppen.

TPG picks up Charterhouse's TSL Education

TPG Capital has acquired TSL Education from Charterhouse Capital Partners in a deal thought to be worth £400m.

Towerbrook acquires majority stake in Metallum

Towerbrook Capital Partners has acquired a majority stake in Metallum Holding, a Luxembourg-domiciled metal refining and recycling company, from private equity firm Groupe Alpha.

Halder acquires Wback in MBO

Halder Beteiligungsberatung has backed the management buyout of German bun producer Wback.

ECI sells CliniSys to Montagu, reaps 2.5x return

ECI Partners has sold CliniSys, a provider of IT systems to the healthcare sector, to Montagu Private Equity, reaping a 2.5x money multiple on its investment.

Private equity firms circle Card Factory

UK greetings card retail chain Card Factory, backed by Charterhouse Capital Partners, has attracted interest from Advent International, KKR and Clayton Dubilier & Rice.

Carlyle picks up Oaktree's Chesapeake

Carlyle has acquired packaging company Chesapeake from Irving Place Capital and Oaktree Capital Management.

L Capital acquires CellularLine

L Capital and DVR Capital have jointly bought a 57% stake in CellularLine, a provider of accessories for smartphones and tablets, from the company’s founders.

Herkules acquires majority stake in PTC

Herkules Capital has acquired a majority stake in Stavanger-based oil services firm Petroleum Technology Company (PTC).

LDC backs £62m Angus Fire MBO

LDCтs Manchester office has supported the ТЃ62m management buyout of Angus Fire from NYSE-listed United Technology Corporation (UTC).

Triton acquires majority stake in Infratek

Triton has agreed to acquire a 76.3% stake in OSE-listed Infratek from its two largest shareholders Fortum Nordic and Hafslund.