Early-stage

Icelandic company Lucinity raises $6.1m in series-A round

Company has raised $9m in total at the series-A stage, from new and existing investors

Fund+ leads €23m series-A for Exevir

Exevir will commit to the international effort to pursue new treatment for Covid-19

Life Science Partners et. al in series-A round for Vico Therapeutics

Biotech startup will use the proceeds to further advance its therapy

Fortunis invests up to £15m in Sportside

Social app allows people to find sports players of a similar age, ability and geography

Sofinnova, AbbVie lead €28m series-A for Enthera

Indaco Venture Partners, JDRF T1D Fund and several Italian investors also take part in the round

Entreprenörinvest and Innovum in $1.1m round for LocalizeDirect

Company will use the proceeds to launch Gridly, a content management system for multilingual game projects

Advent France Biotechnology, Invivo invest €4.25m in Arthex

Company intends to use the fresh capital to advance the development of its myotonic dystrophy therapy

BioMed Partners and HTGF lead €10.7m round for Tubulis

Seventure Partners, Coparion, Bayern Kapital and Occident also back the pharmaceutical company

BIVF et al. back CHF 25m round for T3 Pharmaceuticals

Reference Capital and multi-family office Wille Finance also backed the cancer therapy developer

Cathay Capital leads €30m round for Biose

Company intends to use the fresh capital to strengthen its market position, and expand in the US and China

EVentures leads $4m seed round for Sorare

Fresh capital will be used to scale up Sorare's team and finalise additional licensing partnerships

Osivax raises €33m from EIC and BPI France

Of the funding, €15m from EIC will count towards series-B funding, while the rest will be a grant

Alta Life Sciences, Kurma lead €3.5m series-A for Deepull

Axis Participaciones and Sofimac Innovation, through Pertinence Invest 2, also take part in the round

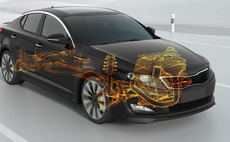

ETF leads €7m round for Basemark

Fresh capital will be used to accelerate Basemark's growth in the field of autonomous vehicles

Seventure, BioGeneration lead €18.5m round for Citryll

Pharma company has so far raised €33.5m from private backers

Beyond Leather Materials raises $1.1m in seed round

Early-stage round led by angel investor Steen Ulf Jensen

Global Founders, Partech in €5.6m seed round for Symmetrical

Partech is currently investing from its Partech Entrepreneur III global seed fund

NordicNinja leads €2.2m seed round for Ziticity

Fresh capital will be used to support geographical growth, as well as fudn further product development

Omnes, Principia, Seventure in €46.3m series-E for Enterome

New investors SymBiosis and Takeda Pharmaceutical Company also take part in the round

Partech, Breega in €10m seed round for Ubble

Investment is an extension to the seed round by angel investors and Partech last year

Consortium in €20m series-A round for Memo Bank

Company also announces it has been given the seal of approval to be a fully-fledged bank

Connecterra raises €7.8m in series-B round

Dutch tech company has raised

MMC leads $3m seed round for Agamon

Fresh capital will be used to scale the company's deployments with more hospitals globally

Asabys, BPI France, Ysios in €30m series-A for Ona Therapeutics

Company intends to use the financing to complete the pre-clinical trial of its lead candidate drug