Early-stage

Sambrinvest joins €23.6m series-B round in bioscience

Sambrinvest has joined Mitsui Global Investment, Shire, ATMI and the Boehringer Ingelheim Venture Fund to invest €17m in Belgian cell therapy company Promethera Biosciences. The Walloon region has granted a further €6.6m in the form of a loan.

CEE's mid-market boom

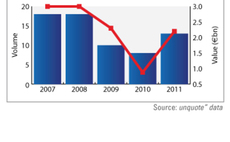

CEE activity was subdued but with encouraging signs in 2011. Q1 saw just €1.7bn clocked up, but this was twice the sum of the whole of the previous year. Also, although activity in H2 was quiet, year-end figures nearly doubled to €2.6bn year-on-year....

Imperial Innovations leads £3m funding round in Abingdon Health

Imperial Innovations Group has led a ТЃ3m funding round in Abingdon Health, a specialist medical diagnostics company, alongside other private investors.

HTGF invests in MediaMetrics

High-Tech Gründerfonds has invested €500,000 in Berlin-based solution software provider MediaMetrics.

Seventure and Lundbeckfond inject €5m in Enterome

Seventure Partners and Lundbeckfond Ventures have provided French biotech company Enterome with a €5m series-A round of funding.

HTGF invests in hepatitis drug project

High-Tech Gründerfonds and Russian Government-backed Maxwell Biotech Venture Fund have invested in a joint project to develop a drug aimed at the treatment of chronic hepatitis B and D.

I2BF leads £1.8m Seren Photonics funding round

I2BF Global Ventures, Fusion IP and IP Group have invested ТЃ1.8m in LED tech company Seren Photonics.

Invercaria and la Caixa back nLife

Invercaria and la Caixa have invested €5m in Granada-based nanomedicine company nLife Therapeutics in exchange for a minority stake.

HTGF leads series-A funding for Bonayou

High-Tech Gründerfonds and "make a startup angel fund" GmbH have invested in PL Gutscheinsysteme's non-cash-gift-voucher card Bonayou.

HTGF and Bayern Kapital back seiratherm

High-Tech Gründerfonds (HTGF), Bayern Kapital and a strategic partner have announced their intention to invest in medical equipment firm seiratherm.

CCMP, Axis and Corpfin back Volotea

CCMP Capital, Axis Participaciones Empresariales and Corpfin Capital have contributed to a €50m funding round to support the launch of Barcelona-based low-cost airline Volotea.

DACH venture scene remains on top form

While the rest of Europe has suffered from a low deal volume in 2011, the DACH early-stage sector is going strong. Considering the well-established venture scene, it is not surprising that this region has dominated early-stage in Q4 2011.

investiere leads series A round for MEDUDEM

investiere, operated by Verve Capital Partners and the Zuercher Kantonalbank have invested CHF 815,000 in medical information provider MEDUDEM.

MKB+ invests €3m in Aeon Astron Europe

Innovatiefonds MKB+ has made the first venture investment in Dutch biotech company Aeon Astron Europe.

Early-stage and Nordics stand out

2011 was a bleak year for the private equity industry, but it was still an improvement on 2010, writes Olivier Marty

High-Tech Gründerfonds backs OakLabs

High-Tech Gründerfonds has invested in German biotech company Oaklabs.

Accel leads $1.5m deal for online payment platform GoCardless

Accel Partners, Passion Capital and YCombinator have injected $1.5m (тЌ1.13m) into British online payment platform GoCardless.

HTGF et al. invest in Conceptboard

High-Tech Gründerfonds and Seedfonds Baden-Württemberg have provided funding for cloud software provider Conceptboard.

Kernel Capital invests €500,000 in Zolkc

Kernel Capital has provided тЌ500,000 of seed funding to tourism technology specialist Zolkc.

UK Watch: Bigger not better in Q4

The smaller buyout segment in the UK thrived in Q4 2011 while larger deals faltered, according to the latest findings of the unquoteт UK watch, in association with Corbett Keeling.

Investor Growth Capital et al. invest $12m in Maxymiser

Investor Growth Capital and Pentech Ventures have backed a series-B funding round of $12m in UK website specialist Maxymiser.

unquote" private equity barometer - Q4 2011

There was a major drop-off in overall deal volume in Q4 2011, with a continuing contraction across all deal stage segments resulting in a total of just 192 deals, the lowest figure recorded since Q4 1996 (158).

Soundcloud raises $50m in Series-C funding round

German online music platform Soundcloud has received an estimated amount of $50m in a funding round led by Kleiner Perkins Caufield & Byers.

HTGF backs Eyesight & Vision

High-Tech Gründerfonds and Bayern Kapital have funded a first round of financing for Eyesight & Vision.