Early-stage

Sunstone Capital backs Adenium Biotech

Sunstone Capital has invested DKK 11m in Danish biotechnology company Adenium Biotech.

Target Partners invests in adeven

Munich-based venture capital firm Target Partners has invested between €1-10m in a series-A funding round for mobile advertising analyst adeven.

HTGF invests in AudioCure Pharma

High-Tech Gründerfonds (HTGF) and business angel Dr Schumacher have provided German drugs candidate developer AudioCure Pharma with seed funding.

Gimv invests £5.7m in series-B round for Prosonix

Gimv has committed ТЃ5.7m to the second closing of a series-B financing round, now totalling ТЃ17.1m, for UK-based pharma Prosonix.

HTGF et al. inject €4.3m into Algiax Pharmaceuticals

High-Tech Gründerfonds (HTGF), private investors and promotional bank KfW have provided German biotech company Algiax Pharmaceuticals with a €4.3m seed funding round.

HTGF backs €1.45m t-cell round

High-Tech Gründerfonds (HTGF) has joined a €1.45m round for regenerative therapies developer t-cell Europe GmbH.

Governments' contribution to VC up six-fold

Government agencies and corporates are increasingly active in venture – but they should push further in support of European VC, argues Olivier Marty

Finance Wales backs Creo Medical

Finance Wales has made a ТЃ1.36m equity injection into Chepstow-based medical devices company Creo Medical as part of a ТЃ3m funding round.

HTGF et al. invest in fos4X

High-Tech Gründerfonds (HTGF), Bayern Kapital and UnternehmerTUM's venture capital arm have invested in fibre-optic measurement business fos4X.

Balderton seeds Archify

Balderton Capital has completed a seed investment in Austrian technology company Archify.

HTGF invests in futalis

High-Tech Gründerfonds has provided German dog food business futalis with seed financing of €500,000.

University and college spinouts make a timid rebound

The funding of Arvia, a spinout from the University of Manchester's School of Chemical Engineering, by MTI Partners for £3.8m is the latest of nine university spinouts noted since the year started.

HTGF et al. invest in Cuciniale

High-tech Gründerfonds (HTGF) and business angels consortium BAC1 have backed start-up Cuciniale GmbH with an undisclosed sum.

Enterprise Investors backs United Oilfield Services

Polish private equity firm Enterprise Investors (EI) has taken a minority stake in Polish oil services company United Oilfield Services for $28m.

HTGF backs KonTEM

High-Tech Gründerfonds (HTGF) has made an investment in German healthcare technology start-up KonTEM GmbH.

HTGF at al. provide seed funding for Oncgnostics

High-Tech Gründerfonds (HTGF) has invested €500,000 in a seed round for molecular diagnostic start-up Oncgnostics GmbH.

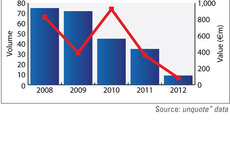

Larger UK buyouts pick up in Q1

Larger buyout activity is picking up pace once again after suffering in late 2011, according to the latest finding of the unquoteт UK Watch, in association with Corbett Keeling.

Seventure leads €3.5m round in LNC

Seventure Partners has led a €3.5m funding round for French medical nutrition specialist Laboratoires Nutrition et Cardiométabolisme (LNC), alongside a pool of new investors and historical backer EPI.

Sunstone joins Index et al to fund Amen Internet

Sunstone Capital A/S and Slow Ventures have joined a $2.9m round in Amen Internet led by Index Venture Management in co-operation with private investors, including a number of celebrities.

Corporates make push into venture capital

As Europe’s newest corporate venture fund makes it first investment, figures suggest corporates are making a heavy push into early-stage financing. Greg Gille investigates.

T-Venture invests €2m in Accel Partners' flaregames

T-Ventures has committed €2m to German mobile gaming company flaregames, a portfolio company of Accel Partners.

HTGF invests in water supply system

High-Tech Gründerfonds has invested €500,000 in water supply measuring system ZIM Plant Technology GmbH.

Business Growth Fund: Myth versus reality

The newest kid on the block т made up of lots of the old boys in the industry т is struggling to make friends. People say the Business Growth Fund (BGF) is too big and too threatening. But is the BGFтs reputation warranted? Kimberly Romaine investigates...

Celtic Therapeutics sets up $50m antibody drug company

Celtic Therapeutics has launched an Antibody-Drug-Conjugate (ADC) business, Switzerland-based ADC Therapeutics, with $50m of capital.