Early-stage

VCs in $80m series-B for Compass Pathways

Compass intends to use the funds to expand upon its lead programme in psilocybin therapy

K Fund in €1m round for Frontity

Company plans to use the financing to improve its framework, roll out new features and grow its community

EQT Ventures leads €4m round for gaming studio Reworks

Studio has launched its first game, Redecor, which targets home decor enthusiasts

Sofinnova invests €16m in Italian biotech company Genespire

GP deploys capital from Sofinnova Telethon Fund, which targets early-stage Italian biotech companies

Wellington Partners makes seed investment in Sirs Therapeutics

Life science and technology investor Wellington is the majority owner of the early-stage company

C Ventures leads series-A for Agile Robots

AI-backed robot and robotic software developer plans to use the fresh capital to develop its product

Andreessen Horowitz leads €7.6m series-A for Mainframe Industries

Gaming startup has so far raised nearly тЌ10m from two funding rounds

Cowen Healthcare in €47m extension round for AM-Pharma

Round comprises €23m in equity and a €24m finance facility provided by the European Investment Bank

Pomerangels backs round for Fully-Verified

Fresh capital will be used to strengthen the company's position in the worldwide identity verification sector

Gradient, Partech lead a $3m seed round for Kaizo

Former partner at IBM Ventures Christoph Auer-Welsbach joins Kaizo as a co-founder

Evli leads $17m series-A for Refurbed

Company aims to reach $100m in GMV in 2020 and to expand to additional European markets

Trustbridge Partners et al. in $41m series-B for FiveAI

Existing investors including Lakestar also back the UK-based autonomous driving startup

Isai, Capgemini join €12m round for Toucan Toco

Isai and Capgemini invested through their joint investment fund Isai Cap Venture

Shoe Investments, Knight Venture in €2.75m series-A for Dealroom

Funding will support Dealroom's continued international expansion in Europe and beyond

Smedvig leads $10m series-A for Yumpingo

Company plans to scale its one-minute instant review platform and launch Yumpingo Pay

Level Equity, Vaekstfonden in $16.9m round for Monsido

Company will use the capital to expand in the North American, EU, and Asia-Pacific markets

Altitude et al. back Nobl series-A

Cannabis data, conference and consulting service was backed by sector-focused investors

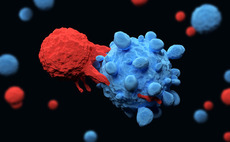

VCs in €20m series-B for PDCLine

In 2016, Belgian VC Meusinvest, Spinventure and several business angels invested €4m in the company

K Fund et al. in €3m round for Bob.io

Company plans to expand internationally and develop new services for passengers' needs

Consortium in €36m series-B for NorthSea Therapeutics

US-based VCs VenBio and Sofinnova Investments back the business for the first time

Versant Ventures et al. back VectivBio

The $35m investment will be used to launch the biotech company following its spin-out from Therachon

Karma et al. back €1.5m round for MeetFrank

Company will use the capital to launch its new "relocation without location" feature

Asabys leads €20m round for Anaconda Biomed

Previous backers Ysios Capital, Sabadell Venture Capital, Innogest and Omega Funds also take part

VC-backed ImCheck Therapeutics raises $53m series-B

Round is co-led by BPI France and Pfizer Ventures, the venture capital arm of pharmaceutical giant Pfizer