Early-stage

Blackstone backs $570m FerGene investment

Ferring is based in Saint-Prex, Switzerland, with 60 subsidiaries globally and 6,500 employees

Ringier Digital Ventures et al. back £3m round for AirConsole

Company receives backing from existing investors Wingman Ventures and angel investors including Christian Wenger

Syncona leads £32m series-B for Azeria

Magda Jonikas and Martin Murphy of Syncona join the board of Azeria Therapeutics

Nauta Capital backs €1.7m round for Airfocus

Business strategy platform will expand its product and triple its team size

NordicNinja, Industrifonden in €3.9m series-A for Combinostics

Funding will be used to scale the company's platform for the US and Asia markets

Eclipse leads $20m series-A for Wayve

Existing investors Compound, Firstminute and Fly Ventures all participated in the round

Redalpine et al. back €6m round for Enway

Enway will use the capital to launch its first autonomous street cleaner

Turbine secures €3m seed funding round

Alan Barge, a partner at Delin Ventures, joins the board of directors of Turbine

DIP Capital, Coparion back €5.5m series-A for Acatus

Berlin-based fintech company will use the capital to grow its digital DCM platform

HV Holtzbrinck et al. back €10m round for Coachhub

German digital coaching and training software company has raised €16m in funding this year

Statkraft Ventures leads €3m series-A for Betterspace

Statkraft Ventures is the venture arm of German energy company Statkraft

HV Holtzbrinck et al. back €11.5m Immo round

Real estate fintech business will use the fresh capital to grow its platform

HTGF et al. in €2.3m round for HQS Quantum Simulations

HQS will use the capital to develop its partnerships in the chemical industry

Atomico leads $56m round for Healx

New investors Global Brain, B-to-V and Intel Capital have invested in the biotechnology company

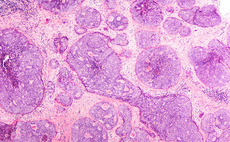

BIVF, Gründerfonds Ruhr lead €12m series-A round for Abalos

Abalos Therapeutics is a biotechnology company focused on developing immuno-oncology therapeutics

VCs in £27m series-A for MiroBio

Advent Life Sciences, SR One, Oxford Science Innovation and Samsara Biocapital have invested

Thrive leads $30m series-B for Pitch

BlueYard Capital, Index Ventures and Slack Fund have previously invested in the company

VC firms back €20m series-A for Stipe

Novo Holdings co-leads the round with Arix and Wellington Partners, and Sunstone Ventures invest

Omnes leads €8.4m funding round for Newronika

Previous backers Indaco Venture Partners and Innogest also take part in the round alongside F3F

Atomico leads $22m series-A in Kheiron

Exor Seeds, Greycroft, Hoxton Ventures and Connect Ventures also invested in the company's series-A

Tera Ventures et al. in $1.4m seed round for Snackable

Existing and new investors back the Estonian-American startup in its second investment round

VCs in €40m series-D for Themis

US-based Farallon Capital, with Oslo- and Stockholm-based Hadean Ventures, led the round for Themis

Morningside leads €39m series-B for biotech company Inotrem

Invus, Andera Partners, Sofinnova Partners and BiomedInvest also take part in the funding round

LSP leads €10.5m series-D for Xeltis

Life Sciences Partners first invested in the medical devices company in 2014