Exits

Corpfin sells Logiters for €85m

Deal sees Corpfin exit the Spanish logistics operator after two-year holding period

Deal in Focus: Quilvest exits Acrotec in uncertain Swiss watch market

An in-depth look at the recent sale of watch component maker Acrotec by Quilvest to Castik

Altor exceeds 25% IRR on Ferrosan Medical Devices exit

Final exit comes five years after GP divested Ferrosan Consumer Health division to Pfizer

EQT sells Spanish parking operator Parkia

EQT Infrastructure and Mutua Madrileña sold the business after a five-year holding period

Inflexion exits CMO to US buyer Mitratech

Risk and compliance company undertook a recruitment drive under Inflexion's ownership

Mannai takes majority stake in Apax-backed GFI

Qatar-based listed group raises stake in French business GFI Informatique to 51.24%

Percipient-backed Cooper Callas goes into administration

UK bathroom and kitchen distributor makes 41 of its 68 employees redundant

Lack of Nordic exits a sign of weak portfolios, says Altor's Mix

Conditions in the Nordic markets could hardly be better for private equity exits, Harald Mix said at a conference

Weinberg Capital-backed Climater acquires Aditec

Weinberg Capital Parners had acquired a majority stake in Climater in 2011

Endless's Liberata sells Trustmarque for £57m

Private equity house Endless exits the business after a two-year holding period

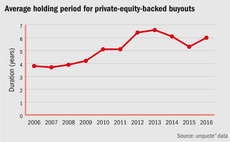

Holding periods lengthening again following 2015 drop

Holding periods for assets exited in so far 2016 have climbed following a drop in 2015, but still sit lower than the 2012-2014 average

Randstad launches tender offer for Siparex-backed Ausy

BPI France and Siparex provided a €20m capital increase in the first funding round for Ausy

Sovereign exits Lifetime Training to Silverfleet

Sovereign had backed the professional training group's management buyout in 2011

Pragma Capital exits Nasse-Demeco to Siparex

Pragma Capital had supported the buyout of the removal company back in 2007

Quilvest sells Acrotec to Castik

Secondary buyout gives the Swiss business Acrotec an enterprise value of CHF 280m

Carlyle sells remaining 13.9% Applus stake for €150m

GP has fully exited the business after a nine-year holding period

Enterprise Investors in €12.3m Nortal exit

Polish GP sells minority stake back to founders and management for milestoned purchase price

EPF Partners and BPI invest in JVS

Previous investors Naxicap Partners, Societe Generale and Euro Capital are exiting the group

Kartesia takes over Desmet Ballestra in lender-led deal

New owner will look to stabilise the group's activity and ensure continuity

Triton buys Fläkt Woods from Equistone and Sagard

Exit comes nine years after the two GPs bought the company in an SBO

Argos Soditic reaps 3x return on Cisbio Bioassays exit

Secondary buyout marks new owner Abenex's 60th investment in France

Electra to float Hollywood Bowl in July

Electra acquired the business, then known as The Original Bowling Company, from CBPE Capital for ТЃ91m in 2014

Viking Venture, GMT et al. exit AddSecure to Abry

Exit is largest-ever for Norwegian VC Viking Venture, exceeding NOK 750m EV

HgCapital exits Mainio Vire to Triton's Mehiläinen

Exit typifies current high demand for healthcare assets in the Nordic market