Exits

Aheim makes second exit in one month

Aheim Capital has sold its portfolio company Ecronova Polymer, reaping a 40% IRR and a 2.5x return on its original investment.

Aheim achieves 2.4x on Aqua Vital exit

Aheim Capital has sold water cooler provider Aqua Vital Quell-und Mineralwasser to fellow German private equity firm Halder, reaping a 2.4x gross money multiple.

ECI Partners' Bargain Booze in IPO

ECI Partners reaped a 4.5x money multiple on its full exit from discount alcohol franchise Bargain Booze, which listed on the London Stock Exchange AIM in an IPO giving the company a market capitalisation of ТЃ66.7m.

Exit focus: Encore finds generalist success in a specialist market

With limited expertise in the software-as-a-service (SaaS) sector, Encore Capitalтs exit of digital marketing company Pure360 is a shining example of how the asset class really can drive operational improvement. Alice Murray speaks to the partners to...

PE-backed Grohe circled by trade players

Plumbing fixtures manufacturer Grohe, which is owned by Texas Pacific Group Capital (TPG) and CSFB Private Equity, has attracted bids from a number of international trade players in an auction that could see the company fetch up to €4bn, according to...

Corpfin Capital makes 2.5x on Duplex sale

Corpfin Capital, the Spanish GP managed by Ascri president Carlos Lavilla, has completed the divestment of lift maintenance firm Duplex Elevación, reaping 2.5x money.

Cinven backs Host Europe

Cinven has agreed to acquire internet domain and hosting company Host Europe Group from Montagu Private Equity for ТЃ438m.

Private equity on the road to recovery

Following a month of stellar exits, an uptick in buyouts and a record number of fundraisings, there is reason to believe private equity markets are turning a corner. Kimberly Romaine reports.

NBGI achieves 4x return on Ochre House exit

NBGI Private Equity has sold Ochre House to Pinstripe, a US-based business backed by Accel and KKR, reaping a 4x return on its original investment.

Battery Ventures buys IHS from Kings Park Capital

Kings Park Capital has exited German marketing company IHS to a newco backed by Battery Ventures, reaping a 3.8x gross money multiple.

Electra reinvests in Allflex as sale completes

Following the completion of the sale to BC Partners, Electra Private Equity has reinvested £57m in animal tags manufacturer Allflex in exchange for a 15% stake.

Elior sale back on track, Axa PE in lead

Axa Private Equity and Caisse de Dépôt et Placement du Québec (CDPQ) have made a revised joint bid for Charterhouse's French catering business Elior, according to reports in the local press.

Omnes backs Eratome SBO

Omnes Capital has made a €15m capital injection into French refurbishment and construction firm Eratome, buying the asset from CM-CIC Capital Privé.

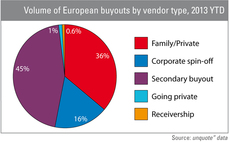

"Pass-the-parcel" deals creep up in H1

Secondary buyouts have accounted for 45% of the overall number of buyouts in the first half of 2013, the highest proportion witnessed since the onset of the financial crisis, according to unquote" data.

Portobello Capital sells Cie to BlackRock

Spanish private equity firm Portobello Capital has sold its remaining stake in listed car parts manufacturer Cie Automotive Group to BlackRock.

Cinven to relinquish control of Frans Bonhomme

Frans Bonhomme, a French plastic pipes specialist owned by Cinven, is reportedly about to be taken over by its creditors.

Matas to unlock the Nordic IPO market?

The recent IPO of Matas, with a market cap of тЌ630m, is the first new listing on the Copenhagen stock exchange in two years. Could this listing be the key to unlocking the hushed Nordic IPO market? Karin Wasteson investigates

Newion exits Mirror42

Newion Investments has divested Amsterdam-based Mirror42, a provider of cloud-based IT intelligence platform solutions, to trade player ServiceNow.

Sentica exits 9lives

Sentica Partners has sold Helsinki-based ambulance and emergency care services company 9lives back to the companyтs management.

BDC's Mezzo di Pasta enters safeguard procedure

Mezzo di Pasta, a French portfolio company of Bridgepoint Development Capital, has gone into "redressement judiciaire", a court-overseen safeguard procedure akin to the UK's receivership.

Terra Firma's Deutsche Annington reattempts IPO

PE-owned German residental real estate company Deutsche Annington Immobilien has renewed its IPO plans.

SüdKB sells MSC-Gruppe to Avnet

Süd-Kapitalbeteiligungs-Gesellschaft (SüdKB) has sold its holding in MSC Investment to Avnet.

Clave Mayor divests Gadea

Spanish venture capital investor Clave Mayor has divested its 9.73% stake in pharmaceuticals company Gadea Grupo Farmacéutico.

Encore Capital exits Pure360, reaping 4x and 47% IRR

Encore Capital has sold digital marketing software company Pure360 for ТЃ10m, reaping a 4x return on the original investment and an IRR of 47%.