Exits

Exit routes: secondary buyouts gain popularity

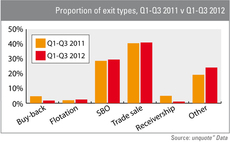

Secondary buyouts have seen their share of the exit market rise, while trade sales hold steady, according to the latest figures from unquote” data.

Nazca buys Ovelar for €28m

Spanish GP Nazca Capital has wholly acquired visual merchandising company Ovelar Merchandising for €28m.

BlackFin acquires minority stake in Groupe Cyrus

BlackFin Capital Partners has taken a minority stake in the MBO of French wealth management firm Groupe Cyrus.

NVM exits Paladin Group

NVM Private Equity has exited its stake in UK-based property services company Paladin Group to trade player Places for People in a deal worth ТЃ15.9m, reaping a 2.3x return on its investment.

Mid-cap valuations dragged down by trade buyers

Valuations down

Volume of exits increases in October

After a slow September, exits picked up again last month, but overall volume seems lower as the year comes to an end.

Northzone et al. exit T-Vips

Northzone and Incitia Ventures have exited their stake in Norwegian broadcast technology company T-Vips.

Enterprise Investors to sell stake in Zelmer

Enterprise Investors has agreed to sell its 49% stake in listed Polish small appliances manufacturer Zelmer to trade player Bosch und Siemens Hausgeräte (BSH) for PLN 298m.

Maven exits Oliver Kay

Maven Capital Partners has exited UK-based fresh foods supplier Oliver Kay Holdings Ltd to Bidfresh Ltd, realising a 2.4x return on its original investment.

AEA and Teachers' Private Capital buy Dematic from Triton

AEA Investors and Teachers' Private Capital, the private equity arm of the Canadian Teachers Pension Plan, have bought German logistics business Dematic in an SBO from Triton.

Quilvest exits recycling firm Paprec

Quilvest Private Equity has sold its stake in French recycling business Paprec to the firm's CEO, sovereign wealth fund FSI (Fonds Stratégique d'Investissement) and Arkea.

Blackstone divests Deutsche Telekom stake

Blackstone has sold around 1.5% of its 4.5% stake in German telecommunications giant Deutsche Telekom AG for an estimated €561m, according to reports.

EdRIP to make 10x on Vessix sale

Edmond de Rothschild Investment Partners (EdRIP) stands to reap a sizeable 10x return on its original investment in US-based Vessix Vascular, following the $425m sale of the business to trade player Boston Scientific Corp.

NBGI Ventures sells TPV to Bausch + Lomb

NBGI Ventures has sold its portfolio company Technolas Perfect Vision (TPV) to Bausch + Lomb, which has exercised an option acquired in 2011.

Alcuin buys TileCo Group from Graphite

Alcuin Capital Partners has backed the management buyout of TileCo Group, a UK-based supplier of tile, mosaic and stone products, from Graphite Capital.

DFJ Esprit exits Redkite

VC firm DFJ Esprit has exited its minority holding in UK-based financial markets surveillance specialist Redkite Financial Markets.

Incitia sell T-VIPS stake in merger with Nevion

Incitia Ventures has sold its 26% share of Norwegian video transport company T-VIPS through merging the business with Herkules Capital portfolio company Nevion.

Lion's £1.2bn partial sale of Weetabix completes

Bright Food's purchase of a 60% stake in Weetabix from Lion Capital is the largest overseas transaction ever by a Chinese company in the food and beverage sector.

Investcorp buys Georg Jensen for $140m

Investcorp has agreed to buy Danish luxury jewellery and silverware manufacturer Georg Jensen for $140m from Axcel Capital Partners.

SEP exits IndigoVision

Scottish Equity Partners (SEP) has sold its stake in Scottish video security business IndigoVision, following a number of unsuccessful MBO attempts.

Waterland buys SENIOcare from Akina

Waterland has bought Swiss long-term care group SENIOcare in an SBO from Akina.

Neo Capital exits Alain Mikli in trade sale

UK-based GP Neo Capital has sold French eyewear brand Alain Mikli International (AMI) to listed Italian trade buyer Luxottica Group.

SBOs back with a vengeance in Q3

Secondary buyouts (SBOs) climbed back to prominence in the third quarter of 2012. The number of such deals rose from 28 to 34 compared to Q2, making it the only buyout segment to record an increase in an otherwise faltering market.

Warburg's Premier Foods offloads condiments business

Premier Foods, a UK-based food products group, has sold its sweet pickle and table sauces division - including the Branston pickle brand - to the Mizkan Group for ТЃ92.5m.