Exits

PE-backed floats stage a comeback

The Ziggo float – and strong post-float performance – illustrates that PE can still pull off a strong exit on the public markets. Kimberly Romaine talks with Warburg Pincus’ Joe Schull about strategies for floating a business in today’s market.

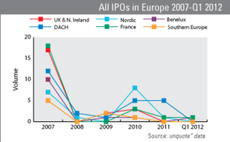

Europe's IPO comeback

Private equity-backed IPOs have had a rollercoaster ride in Europe over the last five years.

LDC reaps 3.8x money on Eveden Group exit

LDC has sold its stake in lingerie and swimwear business Eveden Group to Japanese listed trade player Wacoal Holding Corporation.

Sofinnova Partners lists DBV

Paris-based Sofinnova Partners has listed DBV Technologies, raising €40.5m in the IPO on NYSE Euronext Paris.

Better Capital buys Everest for £25m

Turnaround specialist Better Capital has acquired a 95% in stake in UK-based home improvement products manufacturer Everest in an all-equity, ТЃ25m transaction.

FSN Capital exits VIA Travel

FSN Capital has exited travel management company VIA Travel to NASDAQ-listed trade player Expedia's subsidiary, Egencia.

Percipient generates 18x on Milmega exit

Percipient Capital has exited EMC testing and RF microwave specialist Milmega Limited making 18x its original investment and a 50% IRR.

Altor exits SPT Group at 4-5x multiple

Altor Equity Partners has exited Scandpower Petroleum Technology (SPT) Group to NYSE-listed trade player Schlumberger.

Sentica reaps 2.5x on Idesco exit

Sentica Partners has sold Finnish RFID specialist Idesco to Swedish trade player Lagercrantz Group.

Exit volumes surge despite tough conditions

unquote” data shows that exit volumes surged in 2011 as private equity houses sought to satisfy investor demands, but it is uncertain if this trend will continue in 2012. Anneken Tappe reports.

Permira sells software specialist NDS to Cisco

Permira has reached an agreement to sell NDS Group Limited to Cisco Systems Inc. for approximately $5bn including $1bn debt.

ISIS exits TVC to the Economist

ISIS Equity Partners has sold communications agency TVC to the Economist Group.

Banesto exits Top 30

Banesto Enisa Sepi Desarrollo has sold its 22.6% stake in Spanish climbing wall producer Top 30 to UK-based climbing wall manufacturer Grupo Entre Prises.

Duke Street considers Biomnis exit

Mid-market GP Duke Street has appointed Crédit Suisse to review options - including a potential sale - for French medical analysis business Biomnis, according to a spokesperson.

Venture-backed Groupalia sells Latin American subsidiaries

Daily deals company Groupalia, owned by Nauta Capital, Caixa Capital Risc, General Atlantic, Index Ventures and Insight Venture Partners has sold its Latin American subsidiaries to local Brazilian daily deals site Pez Urbano.

Main Capital sells Dutch software firm Tedopres to Etteplan

Main Capital has exited Dutch software company Tedopres after a six year holding period, completing its second exit in 2012.

Colony Capital completes PSG exit

Colony Capital has sold its remaining 30% stake in French football club Paris St Germain (PSG) to Qatar Sports Investments (QSI) in a deal that reportedly values the club at €100m.

KKR near final exit from Legrand

KKR has sold a further 12.7 million shares in listed French electrical equipment group Legrand, according to reports.

AAC Capital UK sells Amtico to Mannington Mills

AAC Capital UK has sold Amtico Group, an international designer and manufacturer of high end flooring, to Mannington Mills, a US-based provider of branded flooring products.

Apposite reaps 45% IRR on SureCalm exit

Specialist healthcare investor Apposite Capital has sold homecare services provider SureCalm Healthcare to medical technologies developer Amcare Ltd, reaping a 45% IRR.

FF&P sells tea business to Dutch trade player

FF&P's portfolio company Clipper Teas has been acquired by Dutch organic food company Royal Wessanen.

Cinven and Warburg Pincus-backed Ziggo files for IPO

Dutch cable operator Ziggo will list on the NYSE Euronext in Amsterdam, backed by shareholders Cinven and Warburg Pincus.

NPM Capital and Cyrte Investments sell retailer bol.com for €350m

NPM Capital and Cyrte Investments have sold their stake in Dutch speciality retailer bol.com to supermarket giant Ahold for €350m in cash.

Fondations buys Buffet Crampon from Argos Soditic

Fondations Capital has entered exclusive negotiations to acquire French musical instruments maker Buffet Crampon from Argos Soditic.