Exits

BaltCap sells Ecoservice to PE-backed Eco Baltia

BaltCap's exit comes seven years after the GP acquired a 75% stake in Ecoservice for €16.4m

Lindsay Goldberg sells Schur Flexibles to trade

GP acquired the packaging producer from Capiton in 2016 and will retain a 20% stake in the business

Gro-backed Trifork to list in €400m IPO

Planned exit comes six years after software investor Gro Capital invested €6m in Trifork for a 20% stake

KKR buys majority stake in ERM from Omers, AIMCo

Omers Private Equity backed the sustainability consultancy in 2015; the exit is valued at $2.85bn

Summa Equity to sell HyTest in €545m trade deal

Company in 2019 recorded SEK 299m in revenues and an adjusted EBITDA of тЌ15m

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

CVC sells AR Packaging to trade for $1.45bn

CVC Capital Partners has signed an agreement to sell portfolio company AR Packaging Group to listed company Graphic Packaging Holding Company for $1.45bn.

Neuberger exits Service Med to MedicAir

GP sells its 75% stake in the medical company, controlled via Atlante Private Equity Fund

Raise, IDI buy PE-backed Talis Education

Azulis Capital and Aquiti Gestion invested in the professional training provider in January 2020

Sentica exits Finnish IT company Solteq

Exit comes 11 years after the GP, via Sentica Buyout III, invested in Descom, which was acquired by Solteq in 2015

Bain's Parts Holding Europe files for IPO

PE-backed IPOs have been scarce in France in the past five years, according to Unquote Data

Eurazeo sells 49% stake in Trader Interactive in $1.6bn deal

With this sale, Eurazeo reaps a 1.5x return on its initial investment, made in 2017 alongside Goldman Sachs

Eurazeo invests in I-Tracing in €165m deal, Keensight exits

Following the deal, Sagard NewGen invests as a minority shareholder in a holding company controlled by Eurazeo

Hg-backed MeinAuto postpones IPO

Car sales platform cited "currently adverse conditions for high-growth companies" in a statement

Keensight sells LinkByNet to Accenture

Deal ends a five-year holding period for Keensight, which invested €50m in LinkByNet in exchange for a minority stake

Paragon's Apontis Pharma completes IPO

GP acquired the single-pill producer in a carve-out in 2018 and will retain a 31% stake

Neo Investment exits restaurant chain Obicà

Sale ends a nine-year holding period for Neo Investments, which acquired a 52% stake in Obicà from the company's founders

EQT sells StormGeo to Alfa Laval in €363m deal

Deal gives the company an enterprise value of NOK 3.6bn (тЌ363m), which is 17.7x its 2020 EBITDA

Varenne sells Pema to VC-backed JobAndTalent

Trade sale comes a decade after the Swedish GP first invested in Pema in 2011

IK sells Hansen Protection to PE-backed Survitec

IK acquired the protective clothing and equipment producer from Montagu in 2013 via IK Fund VII

NeoGenomics buys VC-backed Inivata for $390m

Inivata will become a separate business division alongside NeoGenomics' clinical, pharma and informatics units

Inflexion sells Reed & Mackay to trade

Sale of the corporate travel business to US-based TripActions is the GP's fifth exit in six months

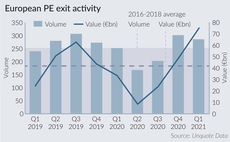

European PE exits back to historic highs in Q1

Greater visibility on the pandemic's impact, attractive comparables and PE's strong appetite on the buy-side embolden managers

Hg's MeinAuto sets IPO price range

Shares are each priced in the €16-20 range, corresponding to a €1.2-1.5bn market capitalisation