Deals

Assietta's Naturalia Tantum buys Di-Va

GP will continue to pursue a buy-and-build strategy aimed at creating a platform in the cosmetics industry

Pantheon and LGT take lead on Medixci continuation vehicle

New €200m vehicle has closed in connection with a six-asset deal

Abry Partners invests in Chimney Vigor Group

Deal follows the merger between Stockholm-based media agency Chimney and US-based tech company OneVigor in September last year

Triton's AVS Verkehrssicherung bolts on SRV Verkehrstechnik

Traffic safety and management company has announced eight add-ons since Triton's 2017 investment

Hg reinvests in Citation

Hg sold the compliance software company to KKR in August 2020 in a transaction valued at ТЃ500-600m

Capza backs IMF Business School

Company's founders, Carlos Martínez and Belén Arcones, stay on with the business and retain a minority stake

3i buys majority stake in GartenHaus

E-commerce company expects to benefit from the growing popularity of leisure and gardening products

Hg sells A-Plan to trade buyer Howden

A-Plan was part of the portfolio of Hg 7, which closed on ТЃ2bn in April 2013

Apax to buy Odigo from Capgemini

Company plans to accelerate its growth and international expansion, while boosting its technological innovation

Nord Holding acquires Bock

Deal is a carve-out from Bock's listed owner, GEA Group, which acquired the company in 2011

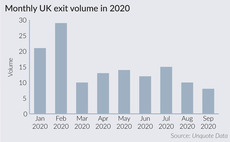

UK exits set to drag in Q3

Early figures from the third quarter suggest that very few GPs will be in sell mode for the rest of the year

Inven, Contrarian lead €5m series A round for Eliq

Startup is a provider of customer engagement software to utility companies

Vam acquires 80% stake in Demenego

A fifth of the company will be retained by the vendor, De Menego family

Ampersand Capital Partners invests in GeneWerk

Pharmaceuticals-focused GP aims to support GeneWerk's growth to meet demand for its services

Agilitas-backed LCG acquires Acorn

Agilitas acquired LCG in March 2020 for an enterprise value of ТЃ125-150m from MML Capital

Ergon's SVT Group buys Odice

Deal sees the fire protection products manufacturer expand in France and brings its turnover to €200m

Apax sells Neuraxpharm to Permira

Deal values the company at more than €1.6bn and is set to generate returns for Apax of 3.5x money

IQ Capital et al. in £5.8m series-A for AccelerComm

Existing investors Bloc Ventures and listed technology investor IP Group also participate

Forto raises estimated €25m from Inven, Northzone et al.

Funding comes from new investor Inven Capital and existing investors Cherry Ventures, Northzone and Cavalry Ventures.

Morningside leads £40.6m series-B for Immune Regulation

Morningside's Isaac Cheng will join the company's board of directors

Icebreaker leads €1.6m round for Fixably

Startup will use proceeds to accelerate its expansion into the US and increase presence in Europe and Asia-Pacific

BGF invests £3m in 365 Response

BGF's investment will be used to accelerate the development of the technology platform

Polaris and AAC Capital exit BabySam to trade – report

GPs had reportedly been preparing to sell BabySam as early as 2017

DACH deal pipeline: live, expected and pulled sale processes

A round-up of sale processes ongoing or expected to launch in the coming months in DACH, courtesy of Unquote sister publication Mergermarket