Deals

HTGF provides seed funding for Flowtify

Prior to the seed round, the startup took part in the Metro Accelerator in October 2015

Bridgepoint takes majority stake in Primonial

Previous investors BlackFin Capital and Latour Capital will exit the group as part of the deal

Finint & Partners buys CVS Ferrari

GP acquires the business to merge it with co-investor BP Handling Technologies

P101 leads €720,000 round for Velasca

GP injects €370,000 ticket alongside private investors and the management team

GCP invests in Shorterm Group

GP has invested with capital drawn from its previously unannounced fourth vehicle

Idinvest et al. in €150m series-E round for Sigfox

Latest round brings total raised by startup to around €230m

Verlinvest buys 24.5% of Mutti

Investor will boost the company's internationalisation and is understood to target an IPO

PM & Partners sells Plastiape for c€150m

Following three-year holding period, the GP sold its stake in an aunction led by Baird and Banca Imi

HTGF and Bayern Kapital in Mecuris seed round

Mecuris claims to operate in a €1.8bn market for prosthetics in Germany

Credo in £1.3m round for Cera

Funding round will support the launch of the London-based online social care platform

Deal in Focus: Nordic Capital doubled Lindorff EV before merger

Managing partner Kristoffer Melinder speaks to unquoteт about the company's merger with its listed competitor

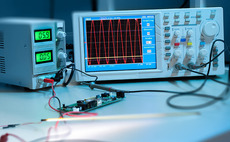

LDC exits Microlease to US competitor Electro Rent

Electro Rent is a portfolio company of American private equity firm Platinum Equity

Better Capital in exclusivity over £326m Gardner sale

Sale price would be above the figure sought for the aerospace company when it was first put up for sale

Ardian, Keensight, Parquest acquire Unither

Unither was acquired from a consortium of investors led by Equistone Partners Europe

Maj Invest sells KK Group to former Altor partners

Scandinavian investment firm Solix acquires the Danish wind turbine component maker

Warburg, General Atlantic sell 50% stake in Santander AM

Buyout firms Warburg Pincus and General Atlantic exit the asset after a three-year holding period

Omnes reaps 5x in Nomios exit to Waterland's Infradata

Omnes supported the group's management buyout in 2013 alongside Odyssee Ventures

Bridgepoint sells Oasis to Bupa for £835m

Sale of British private dental healthcare provider follows three-year holding period

HTGF in Filestage seed round

Germany-based VC High-Tech Gründerfonds usually invests €600,000 at the seed stage

IBB in €4.2m SearchInk round

IBB invested together with former Google engineering director Michael Schmitt

Ratos sets date and price range for Arcus IPO

Norwegian spirits group sets NOK 39-45 price range for shares ahead of 1 December listing

Exponent acquires Livingbridge-backed Enra

Deal for specialist finance company comes three years after Livingbridge's initial investment

Polytech in $9.7m series-A for Ava

Other Swiss and American investors joined Polytech in the series-A round

CapHorn, Turenne Capital et al. in €3m round for Fidzup

New round brings total funding raised by the French software startup to €3.3m