Deals

Mandarin Capital sells Gasket

Mandarin Capital Partners (MCP) has sold its shareholding in Italian valves components producer Gasket International to Hutchinson, a French thermoplastics firm.

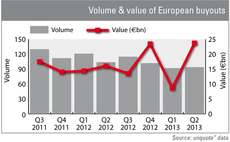

Q2: overall buyout value soars by 174%

The European buyout market recovered spectacularly in value terms in Q2 on the back of a string of mega-deals, but the overall volume of activity remains lacklustre.

HTGF backs NovaPump in series-A funding

High-Tech Gründerfonds has invested in medical company NovaPump as part of a series-A funding round.

Acromas results spur further split speculation

Acromas, comprising AA and Saga and backed by CVC, Charterhouse and Permira, has reported a 4.9% uplift in EBITDA, reawakening speculation over how its financial backers will exit the business.

ECI reaps 4.5x on Bargain Booze IPO

ECI Partners has reaped a 4.5x money multiple on its full exit from Bargain Booze, which listed on the AIM this morning under its holding company, Conviviality Retail.

Holtzbrinck Ventures leads series-A investment in L'ArcoBaleno

Holtzbrinck and other investors have taken part in a seven-figure funding round for design e-commerce site L’Arcobaleno.

Activa buys majority stake in listed Nexeya

Activa Capital has acquired a 57.9% stake in NYSE Euronext-listed Nexeya, alongside BPI France Investissement, and launched an offer for the remainder of the shares.

Italian VCs inject €2m into Personal Factory

IMI Fondi Chiusi has joined existing backers Vertis and Fondamenta in a €2m round for building materials company Personal Factory.

Octopus leads £3.7m investment in Amplience

Octopus Investment, joined by existing shareholders as well as new investor Northstar Ventures, has led a ТЃ3.7m series-B funding round for e-commerce technology company Amplience.

Idinvest et al. back Grand Cru with €8.5m

Idinvest Partners, Qualcomm Ventures and Nokia Growth Partners have taken part in an тЌ8.5m series-A funding round for Finnish game developer Grand Cru.

Waterland sells SLG to Medica

Waterland Private Equity Investments has wholly divested its Belgian portfolio company Senior Living Group (SLG) to Medica, a France-based dependency care provider.

Direct secondaries set to peak in 2017

The volume of the direct secondaries market has already doubled in the last year and is set to continue expanding rapidly, according to recent research by placement agent Triago.

HTGF's Capical receives series-A funding

KfW and M-Invest have invested in Capical, a medical technology company backed by High-Tech Gründerfonds (HTGF), in a series-A funding round.

Abraaj divests Acibadem Insurance

The Abraaj Group has sold its 50% stake in Turkish health insurance firm Acibadem Sağlık ve Hayat Sigorta (Acibadem Insurance) to Khazanah Nasional Berhad, the Malaysian government’s strategic investment fund.

Endless's Karro secures £60m refinancing package from GE

Karro Food Group has received a ТЃ60m funding package from GE Capital just six months after Endless acquired the company.

Darwin PE backs £11m Esendex MBO

Darwin Private Equity has acquired UK-based Esendex, a provider of short message service (SMS) solutions for businesses, in an ТЃ11m management buyout led by the companyтs newly-promoted CEO.

IK acquires Ampelmann

IK Investment Partners has bought a majority stake in Netherlands-based Ampelmann, a provider of motion technology systems and structures for the offshore energy sector.

Midven backs Learning Labs

Midven has invested ТЃ300,000 in Learning Labs' language learning product FlashSticks, which uses 3Mтs Post-it notes.

Imperial et al. back Polytherics and Antitope merger

Imperial Innovations, Mercia Fund Management, Catapult Venture Managers and Invesco Perpetual have provided ТЃ13.5m for the takeover of Antitope by UK-based biotechnology firm Polytherics.

Activa-backed La Maison Bleue bolts on Crèches Baby

French childcare nursery group La Maison Bleue, which is backed by Activa Capital, has acquired day-care nursery chain Crèches Baby & Co from its parent company Delfingen.

MML Capital exits Clyde Bergemann

MML Capital Partners (MML) has sold its minority stake in Clyde Bergemann, a global provider of energy services.

Principia backs Rysto with $1m

Italian venture capital firm Principia has injected $1m into Rysto, an online portal for jobseekers in hospitality and catering.

Pamplona set to buy OGF from Astorg

Pamplona Capital Management is set to acquire French funeral services provider OGF from Astorg Partners, a deal reportedly valued at around €900m.

Mobeus supports Veritek MBO

Mobeus Equity Partners has backed the ТЃ11m management buyout of Veritek Global, a provider of technical services.