Deals

Graphite tucks into Hawksmoor

Graphite Capital has succeeded in its bid to acquire Hawksmoor, supporting the high-end steak restaurant group's management buyout.

Ambienta sells Tower Light

Italian environmental investor Ambienta has sold lighting tower producer Tower Light to listed US-based generator manufacturer Generac.

CM-CIC LBO Partners' Nerim acquires Boost

Internet and telecoms operator Nerim, which is backed by CM-CIC LBO Partners, has acquired software-as-a-service (SaaS) solutions provider Boost.

Q2 Barometer: overall value rockets by 175%

Q2 Barometer

Perusa exits Kammann Maschinenbau in trade sale

Perusa has sold its 85% stake in printing services supplier Kammann Maschinenbau to corporation Koenig & Bauer.

Finance Yorkshire exits S3 ID

Finance Yorkshire, via its Finance Yorkshire Equity Fund, has divested its 25% stake in UK-based S3 ID to CSE Global, reaping a 2.2x money multiple in a trade sale that values the company at ТЃ10m.

Xanit bolts on Croasa

Xanit International Hospital, the healthcare provider backed by N+1 Mercapital and Partners Group, has completed the bolt-on of oncology centre Croasa.

Aheim makes second exit in one month

Aheim Capital has sold its portfolio company Ecronova Polymer, reaping a 40% IRR and a 2.5x return on its original investment.

Aheim achieves 2.4x on Aqua Vital exit

Aheim Capital has sold water cooler provider Aqua Vital Quell-und Mineralwasser to fellow German private equity firm Halder, reaping a 2.4x gross money multiple.

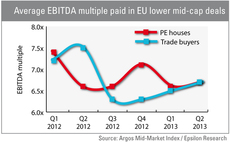

Mid-cap valuations remain stable as dealflow stagnates

Mid-cap valuations

Index et al. back Wool And The Gang with $2.8m

UK-based knitwear e-commerce company Wool And The Gang has raised $2.8m from Index Ventures, Wellington Partners and MMC Ventures.

Strong branding boosts dealflow

A new study has revealed that 88% of CEOs believe a strong venture capital brand helps to attract entrepreneurs and improves dealflow.

ECI Partners' Bargain Booze in IPO

ECI Partners reaped a 4.5x money multiple on its full exit from discount alcohol franchise Bargain Booze, which listed on the London Stock Exchange AIM in an IPO giving the company a market capitalisation of ТЃ66.7m.

Atlas leads €2.5m round for Harbour Antibodies

Atlas Venture has led a €2.5m funding round for Rotterdam-based Harbour Antibodies, an engineer of transgenic mice designed to produce high-affinity human antibodies.

Qualium backs Mériguet group

Qualium Investissement has invested in the owner buyout (OBO) of the Atelier Mériguet-Carrère group, a Paris-based arts specialist and renovator.

Electra refinances Park Resorts

Electra Partners has refinanced the existing debt of portfolio company Park Resorts - the GP now holds debt facilities totalling ТЃ145m and has upped its stake in the company to 54%.

Sycamore Aviation lands £750,000 investment

Durham-based Sycamore Aviation has received a ТЃ750,000 cash injection from a syndicate of investors led by regional firm FW Capital.

Exit focus: Encore finds generalist success in a specialist market

With limited expertise in the software-as-a-service (SaaS) sector, Encore Capitalтs exit of digital marketing company Pure360 is a shining example of how the asset class really can drive operational improvement. Alice Murray speaks to the partners to...

BlackFin buys DevisMutuelle and KelAssur

BlackFin Capital Partners has acquired insurance comparison sites DevisMutuelle and KelAssur.

United Ventures supports LoveTheSign

United Ventures has led a €1m funding round for e-commerce interior design site LoveTheSign.com.

Jobandtalent raises €2.5m from Kibo Ventures et al.

Spanish venture capital investor Kibo Ventures has led a €2.5m funding round for recruitment firm Jobandtalent.

Gimv et al. back Jenavalve

A consortium of venture capital investors has injected $62.5m as part of a series-C round for Jenavalve Technology, a Germany-based medical devices manufacturer.

PE-backed Grohe circled by trade players

Plumbing fixtures manufacturer Grohe, which is owned by Texas Pacific Group Capital (TPG) and CSFB Private Equity, has attracted bids from a number of international trade players in an auction that could see the company fetch up to €4bn, according to...

MMC in $1.5m round for Invenias

MMC Ventures has taken part in a $1.5m funding round for UK-based Invenias, a cloud-based search software provider for executive recruitment firms.