Deals

PE-backed Kion Group to list

German forklift manufacturer Kion Group, backed by KKR and Goldman Sachs Capital Partners, is considering an initial public offering, according to reports.

Sun Capital merges five portfolio companies

Sun Capital has announced plans to combine five of its US and European plastic packaging businesses to create Luxembourg-based Exopack Holdings Sarl, the sixth largest company of its kind worldwide.

Permira sells more Hugo Boss shares

Permira is to sell seven million shares, or a 10% stake, in German high-end fashion house Hugo Boss, according to reports.

Elysian Capital buys Axis Well Technology

Elysian Capital has backed the management buyout of Aberdeen-based oil and gas consultancy Axis Well Technology.

Electra to reap 15x on Allflex

BC Partners has made a binding offer of $1.3bn to Electra Partners for its French animal tags business Allflex, following an intense auction process that attracted bids from a dozen private equity firms.

Intel Capital leads €7m funding round for FeedHenry

Intel Capital has led a group of GPs and one trade player in a тЌ7m funding round for cloud-based mobile applications platform provider FeedHenry.

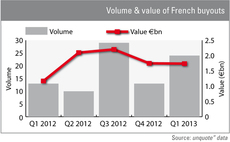

French buyouts up 50% YoY in Q1

The French buyout market enjoyed a much welcome uptick at the start of 2013, with both volume and overall value significantly up on Q1 2012 figures.

Novo AS et al. round up €141m Symphogen financing

Novo AS, PKA and Danica Pension have provided Danish biopharmaceutical company Symphogen with a further тЌ41m, rounding up a тЌ141m funding round for the business.

Calculus Capital and SAEV invest in Antech

Calculus Capital and Saudi Aramco Energy Ventures (SAEV) have backed UK-based Antech, a developer of directional coiled tubing drilling products and services.

Duke Street hunts for new backers ahead of fresh fundraising

Duke Street Capital is looking for new backers to replace existing investors in its funds ahead of a fresh fundraising attempt, according to reports.

Argos seals Sage subsidiaries deal

Mid-cap GP Argos Soditic has completed the all-equity acquisition of four software-focused subsidiaries of Sage in France and Spain.

Invision buys Kraft & Bauer

Swiss firm Invision Private Equity has bought German fire protection business Kraft & Bauer Brandschutzsysteme (K&B) as part of a succession solution.

Panoramic invests £1.8m in Andante Travels

Panoramic Growth Equity has injected ТЃ1.8m into archaeological travel operator Andante Travels via its maiden fund, Panoramic Enterprise Capital Fund I (PECF I).

Isis backs Sage Construction MBO

Isis Equity Partners has backed the MBO of Sage Construction from software company Sage (UK) Ltd.

Almi and Chalmers Innovation back Halon

Almi Invest and Chalmers Innovation Seed Fund have backed Swedish web security solutions provider Halon Security.

Charterhouse buys Armacell for €500m

Charterhouse has agreed to acquire German insulation company Armacell from Investcorp in a €500m secondary buyout.

Herkules's Bandak Group acquires ITM

Herkules Capital portfolio company Bandak Group AS has agreed to acquire IOS Tubular Management AS (ITM) from Breimyra Invest AS.

Novartis Venture et al. in €33m series-C round for Opsona

A consortium of new and existing investors has injected тЌ33m into Irish immunology drug development company Opsona Therapeutics as part of a series-C funding round.

DFJ Esprit et al. back M-Files Corporation

DFJ Esprit and Finnish Industry Investment have injected тЌ6m into M-Files Corporation, a technology start-up based in Finland.

FF&P Private Equity acquires FIT

FF&P Private Equity has backed the buy-in management buyout (BIMBO) of specialist energy efficiency firm Food Industry Technical Ltd (FIT).

Springer Science sale back on

Germany could be home to another mega-buyout this year following news that EQT is in renewed talks with private equity investors over a potential sale of German publishing business Springer Science.

VC-backed Shazam to pursue IPO

Shazam, a London-based mobile music recognition app developer, is to pursue an initial public offering.

Herkules Capital exits Gothia to arvato AG

Herkules Capital has agreed to sell Gothia Financial Group AS to arvato AG, a global business process outsourcing (BPO) provider owned by Bertelsmann.

PAI scoops up R&R Ice Creams

French large-cap specialist PAI partners has struck a deal to buy British ice cream manufacturer R&R Ice Cream from Oaktree Capital for тЌ850m.