Deals

Verdane Capital exits KSD to Descartes

Direct secondaries specialist Verdane Capital has sold KSD Software Norway AS to The Descartes Systems Group for NOK 190m.

Caixa Capital Risc leads €1.1m round for iMicroQ

Caixa Capital Risc has led a €1.1m funding round for Spanish biotech firm iMicroQ.

Key Capital's Templine acquires A&A Recruitment

Templine Employment Agency Ltd, a recruitment company backed by Key Capital Partners (KCP), has acquired UK-based A&A Recruitment Ltd.

Mercia backs Ventive in series-A round

Birmingham-based venture capital firm Mercia Fund Management has backed low-carbon ventilation product developer Ventive in a ТЃ900,000 series-A funding round.

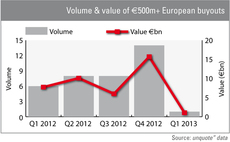

Q1 Barometer: Deal value hits four-year low

Q1 Barometer

Large-cap market awakens after tepid Q1

European buyouts valued in excess of €500m have been conspicuous in their absence in the first quarter following a flurry at the tail-end of 2012 – but recent weeks have shown signs of a revival.

Calao invests in Contrejour

French GP Calao Finance has provided shutters manufacturer Contrejour with fresh equity.

Cardio3 raises €19m in new funding round

Belgian biopharmaceutical company Cardio3 Biosciences has completed a funding round that saw previous investors inject €7m in new equity alongside the conversion of €12m in existing convertible loans.

Investment AB Kinnevik et al. invest $20m in Foodpanda

Investment AB Kinnevik and Phenomen Ventures have led a funding round in excess of $20m for Foodpanda, a global food delivery service.

Calculus invests £1.1m in Benito's Hat chain

Calculus Capital has invested ТЃ1.1m, alongside a further ТЃ300,000 from existing investors, in London-based Mexican food chain Benitoтs Hat.

Omega Funds leads $10m round for SpineVision

Omega Funds has led a $10m funding round for French medical devices provider SpineVision, which also included investments from two other new backers.

Darby exits Sirma to Danone

Darby Private Equity is set to sell its holding in Sirma, a Turkish bottled water and beverages manufacturer.

FTBPro raises $5.8m from VC duo

Battery Ventures and Gemini Israel Ventures have provided $5.8m to FTBPro, a fan-generated football content platform based in London.

Octopus leads £2m TrialReach round

Octopus Investments and Amadeus Capital Partners have provided UK-based clinical trials search business TrialReach with a ТЃ2m round of funding.

3i sells Civica to Omers Private Equity

3i has sold specialist IT systems and services firm Civica to Omers Private Equity for an enterprise value of ТЃ390m.

CCMP acquires Pure Gym

CCMP Capital Advisers has backed Pure Gym's management in a secondary buyout of the UK-based company, which previously received funding from Magenta Partners.

Vertis buys minority stake in Arav

Italian VC investor Vertis has agreed to commit €9m to Naples-based clothing producer Arav in exchange for a minority stake.

Foresight backs Procam MBO

Foresight Group has backed the MBO of Procam TV, a UK broadcast hire company.

ECM acquires MediFox Group

ECM Equity Capital Management has acquired MediFox Group, a German software provider for the care industry, alongside management as part of a succession solution.

Isis backs MBO of Red Box

Isis Equity Partners has invested ТЃ14m in digital recording specialist Red Box Recorders as part of a management buyout.

Kurma leads €17m series-B round for Stat Diagnostica

Kurma Life Sciences Partners has led a €17m series-B round for Spanish medical diagnostics company Stat Diagnostica.

Bridgepoint buys Flexitallic Group from Eurazeo

Bridgepoint has acquired Paris-based sealing solutions business The Flexitallic Group from Eurazeo PME for €450m.

H2 makes 6x on Sator sale

H2 Equity Partners has reaped a 6x multiple on the trade sale of Dutch portfolio company Sator Holding to LKQ for £176m.

Newion acquires stake in Reasult

Newion Investments has acquired a minority stake in real estate software provider Reasult via its third fund, Newion II.