Deals

CGS takes majority stake in Top-Werk Group

CGS Management has invested in the merger of SR-Schindler Maschinen Anlagentechnik GmbH and Prinzing GmbH Anlagentechnik und Formenbau, which together will form the Top-Werk Group.

Siparex invests €1m in VitrineMedia

Siparex has injected €1m into French back-lit signs manufacturer VitrineMedia.

Penta-backed Esure moves forward with IPO plans

Penta Capital's portfolio company Esure has confirmed its intention to list on the London Stock Exchange.

Seventure et al. inject €7.1m into Recommerce Solutions

Seventure Partners, CDC Entreprises and 3T Capital have provided French used electronic products retailer Recommerce Solutions with a €7.1m round of financing.

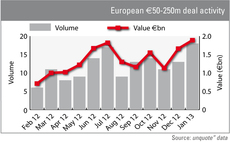

Lower mid-market buyouts hit €2bn record in January

France and the UK led Europe in January in the lower mid-market, which saw 18 such transactions across Europe worth a combined €1.9bn - the largest monthly value witnessed for a year. Greg Gille reports

Lyceum's Access Group acquires Sazneo

Lyceum Capital portfolio company Access Group has acquired British business software provider Sazneo.

Isis sells LBM Direct Marketing to Stream Global Services

Isis Equity Partners has sold its stake in British data provider LBM Direct Marketing to US trade buyer Stream Global Services.

Mid-cap valuations pick up in Q4 2012

Mid-cap valuations

NorthEdge backs FPE Global in maiden deal

NorthEdge Capital has taken a majority stake in UK-based engineering firm FPE Global.

HTGF et al. invest in Notion Systems

High-Tech Gründerfonds (HTGF) has led a financing round for Notion Systems, a German developer of inkjet, laser and automation equipment for technical applications.

Northzone leads €3m funding round for Trac ID Systems

Northzone has invested тЌ3m in Statoil-owned Norwegian RFID tracking and optimisation company Trac ID Systems.

NBGI acquires Stiplastics

NBGI Private Equity has acquired French packaging company Stiplastics.

Nordic Capital acquires Ellos

Nordic Capital Fund VII has agreed to acquire Swedish home shopping companies Ellos and Jotex from Redcats, a wholly-owned subsidiary of French company PPR.

Torsa Capital injects €500,000 into Hielos de Asturias

Spanish investor Torsa Capital has injected €500,000 into Hielos de Asturias, a manufacturer and distributor of ice and frozen dough.

DN Capital, MCI lead €15m round for windeln.de

DN Capital and MCI have invested in the latest and largest round for windeln.de.

DBAG backs MBO of Formel D GmbH

Deutsche Beteiligungs AG (DBAG) has invested in the management buyout of German support services company Formel D GmbH.

Mobeus invests further £3.2m in Motorclean

Mobeus Equity Partners has provided an additional ТЃ3.2m to Motorclean, the specialist car valeting business acquired by the GP in 2011.

Inkef invests €7.5m in Sapiens

Inkef Capital has invested €7.5m in Dutch medical technology company Sapiens Steering Brain Stimulation (Sapiens), extending the company's series-A funding.

Elbrus buys OSG Records Management from Aurora Russia

Elbrus Capital has acquired Russian storage and records company OSG Records Management from Russian investment company Aurora Russia.

Equistone to buy Meilleurtaux

Equistone has entered into exclusive negotiations with French banking group BPCE regarding the sale of real estate mortgage adviser Meilleurtaux.

CVC places Evonik shares as IPO markets wake up

CVC is the latest GP taking a more flexible approach to exiting its businesses, selling a share in chemicals business Evonik to institutional investors in preparation for an IPO.

Amadeus Capital Partners backs Bellco

Amadeus Capital Partners has entered the shareholding of Italian dialysis technology company Bellco, owned by Montezemolo & Partners.

Litorina et al. invest in Kontorsvaruhuset Gullbergs merger

Litorina Capital Partners has backed a merger to form the new group Kontorsvaruhuset Gullbergs, a Swedish supplier of office wares and related services.

Connection Capital and Riverside buy the Cresta Court Hotel

Connection Capital and Riverside Capital have teamed up to acquire the Cresta Court Hotel in Altrincham and its operating company Harrop Hotels in a ТЃ2.95m MBI.