Deals

Capital cities attract most private equity investments

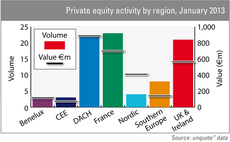

Europe’s capital cities attract the lion's share of private equity investment, though other regions in Europe have been shown to be very active, according to new research from unquote” data.

Connection Capital buys £9m TeamSport Racing

Connection Capital has invested in the ТЃ9m management buyout of UK-based go-karting tracks operator TeamSport Racing Ltd.

LDC backs barriers manufacturer ATG Access

LDC has made a minority investment in ATG Access, a British manufacturer of vehicle barrier systems.

Investcorp acquires Hydrasun from Equistone

Investcorp has bought Aberdeen-based oil and gas services business Hydrasun Ltd in a secondary buyout from Equistone Partners Europe.

CapMan sells remaining shares in MQ

CapMan has sold its entire 28% stake in listed Swedish fashion retail chain MQ for SEK 16 per share, according to reports.

Permira and KKR sell €485m ProSiebenSat.1 stake

Permira and KKR have sold shares in jointly-owned German media giant ProSiebenSat.1 on the Frankfurt stock exchange for €485m.

Moscow Exchange IPO sets market cap at $4.2bn

Private equity-backed Moscow Exchange (MICEX) has set its IPO offer price at RUB 126.9bn ($4.2bn).

Private equity players circle Republic

The founder of fashion chain Republic, which went into administration earlier this week, is considering teaming up with a private equity buyers to rescue the business, according to reports.

Scottish Enterprise et al. back Lux Assure

Scottish Enterprise has taken part in a ТЃ3.25m funding round for Edinburgh-based technology development business Lux Assure.

PE-backed Labco in €100m high-yield refinancing

French medical diagnostics company Labco has made a €100m bond issue to repay the outstanding amounts borrowed under its revolving credit facility.

Ace and CM-CIC in €3.2m round for Socomore

Ace Management and existing backer CM-CIC Capital Finance have taken part in a €3.2m funding round for Socomore, a French producer of surface treatment solutions used in the aerospace industry.

Private equity backers sell Rexel stake for €640m

Private equity backers including Clayton Dubilier & Rice and Eurazeo have sold a 14.7% stake in French listed electrical distributor Rexel for €640m.

Vendis Capital backs Hypo Wholesale

Vendis Capital has taken a majority stake in Dutch equestrian equipment wholesaler Hypo Wholesale.

HTGF backs linkbird

High-Tech Gründerfonds (HTGF) and six business angels have backed Berlin-based technology company linkbird.

Finance Wales et al. invest in Vizolution

Finance Wales has led a series-A funding round worth ТЃ750,000 for Welsh software company Vizolution.

Argos Soditic buys FIS and Antex

Argos Soditic has acquired a majority stake in Italian firms FIS and Antex, which operate human resources and finance and administration outsourcing services, through the newco Fahr Servizi.

Omnes Capital invests €50m in Exclusive Networks

Omnes Capital has committed €50m to French IT security software business Exclusive Networks to fund further acquisitions, according to reports.

BGF backs Aubin with £2.3m

The Business Growth Fund (BGF) has backed Scottish oil and gas services company Aubin with a ТЃ2.25m investment.

MTI et al. invest in Oxford Photovoltaics

MTI Partners has led a ТЃ2m investment round for Oxford Photovoltaics Ltd (OPV), an Oxford University spinout commercialising solid-state solar cells.

UK activity falls behind France and DACH

The UK & Ireland private equity market has been overtaken by the French and DACH regions in January according to figures from unquoteт data.

Greylock Partners backs Social Point

US venture capital investor Greylock Partners has reportedly injected $2.9m into Spanish online games producer Social Point.

Electra in £56m secondaries deal

Electra Partners has acquired stakes in five private equity funds from an unnamed bank for ТЃ56m.

Arle's Innovia acquires additional 50% in Securency

Arle Capital Partners' UK chemical company Innovia Films has acquired the remaining 50% stake in joint venture Securency International from the Reserve Bank of Australia (RBA).

Mercapital sells Lasem Group to management

Spanish GP Mercapital has sold its 41% stake in Catalan company Grupo Lasem, which operates in the baking and confectionery industry, according to reports.