Deals

Equistone sells Kermel to Qualium

Qualium Investissement has acquired a majority stake in French fibre manufacturer Kermel from Equistone Partners Europe, which is understood to have reaped a 2.2x money multiple on the sale.

PE-backed BMG linked to Parlophone bid

Private equity-backed music group BMG Rights Management has been linked to a bid for Parlophone Records, a section of EMI responsible for music by bands including Coldplay and Radiohead.

AXA PE acquires Fives from Charterhouse

AXA Private Equity has backed the management buyout of industrial engineering firm Fives Group in a deal that values the company at around €850m.

Finance Wales et al. complete Clinithink series-A

Finance Wales has taken part in the multi-million-dollar second tranche of a series-A funding round for UK-based healthcare software company Clinithink, alongside existing investors.

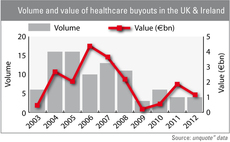

Are buyout firms well placed for healthcare reforms?

UK healthcare

Hony and GCS named preferred bidders for Dexia unit

Chinese private equity houses Hony Capital and GCS Capital have teamed up to buy the asset management arm of Dexia in a deal worth €500m, according to reports.

LDC takes Boomerang private

LDC has acquired AIM-listed media production company Boomerang in a take-private worth close to ТЃ8m.

North West Fund backs PlaceFirst

The North West Fund for Energy & Environmental, managed by CT Investment Partners, has acquired a minority stake in UK-based energy and regeneration business PlaceFirst.

Mid Europa backs Walmark

Mid Europa Partners has acquired a 50% stake in Czech dietary supplements manufacturer Walmark from the company's founders.

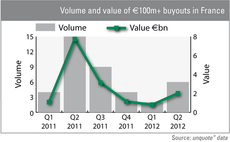

French mid-market on the mend

At long last, activity in the French €100m+ buyout market showed signs of improvement in the second quarter. The Alain Afflelou and St Hubert transactions certainly helped: the former was acquired by Lion Capital in an €800m SBO in May, while Montagu...

Cross acquires Micromacinazione

Swiss firm Cross Equity Partners has acquired a majority stake in Swiss micronisation technologies and services company Micromacinazione.

Siparex takes 25% stake in Vulcain

Siparex has acquired a minority stake in the owner buyout of French building fixtures manufacturer Vulcain.

MBO Partenaires buys 80% of LMB

MBO Partenaires has taken a majority stake in the management buyout of French aerospace parts supplier LMB.

IK buys Actic from FSN Capital

IK Investment Partners has acquired Swedish health and fitness business Actic from FSN Capital.

T-Venture backs DropGifts

T-Venture has backed Berlin-based social gifts start-up DropGifts with a seven-digit-euro investment.

Activa's Ergalis acquires three businesses

Ergalis, a build-up platform created by Activa Capital, has acquired French temporary employment agencies and recruitment services businesses Action Beauté Cosmétique Interim, Action Assistance and Talentpeople.

Mid-cap GPs pay less than corporates as entry multiples drop

For the first time in two years, between April and June, private equity houses paid a lower median entry multiple than corporate buyers in mid-cap transactions, according to the latest Argos Mid-Market Index.

Perusa buys TLT Group

Perusa has wholy acquired German automotive logistics business Trans-Logo-Tech Group (TLT) via its €207m Perusa Partners Fund II.

Vertis backs Blomming

Italian investor Vertis has backed social network e-commerce site Blomming.

Omnes Capital invests in Unafinance MBI

Omnes Capital (formerly Crédit Agricole Private Equity) has backed the management buy-in of French building security company Unafinance.

AXA PE buys Schustermann & Borenstein

AXA Private Equity has bought German fashion exporter Schustermann & Borenstein in an MBO that reportedly values the company at $370m.

Mobeus in £18m Tessella MBO

Mobeus Equity Partners has pumped ТЃ18m into science-focused technology and consulting services provider Tessella, marking the GP's first buyout since its spinout from Matrix Group.

Imperial Innovations in £17m round for Cell Medica

Imperial Innovations Group has invested in a ТЃ17m funding round for its portfolio company Cell Medica.

Index et al. partially exit Funxional Therapeutics

Index Ventures, Novo A/S and Ventech have partially exited their investment in Funxional Therapeutics, following the companyтs sale of its rights to lead anti-inflammatory drug FX 125L to German pharmaceuticals company Boehringer Ingelheim.