Deals

Gimv invests £5.7m in series-B round for Prosonix

Gimv has committed ТЃ5.7m to the second closing of a series-B financing round, now totalling ТЃ17.1m, for UK-based pharma Prosonix.

LDC-backed Avelo acquires TrigoldCrystal

LDC portfolio company Avelo has completed the strategic acquisition of London-based mortgage solutions provider TrigoldCrystal.

Nauta subscribes to €4.5m Yuilop round

Nauta Capital has participated in a €4.5m series-A funding round for portfolio company Yuilop, a Spanish smartphone software developer.

notonthehighstreet.com receives £10m series-D funding

Fidelity Growth Partners Europe (FGPE) has joined previous investors Index Ventures and Greylock Partners in a ТЃ10m funding round for UK online business notonthehighstreet.com.

£70m restaurant bill could generate 2x for Caird

Caird Capital may be about to exit its minority stake in restaurants chain D&D London.

Mid-cap valuations register modest drop – Argos Index

Modest drop in mid-cap valuations

FSI Régions and Alliance Entreprendre invest in Fabulous Garden

FSI Régions and Alliance Entreprendre have injected €1m into French outdoor furnishings company Fabulous Garden.

Montagu's Host Europe buys Mesh Digital

Montagu-owned Host Europe Group (HEG), a London-based web hosting business, has acquired domain registration services provider Mesh Digital.

CBPE buys minority stake in IVF clinic

CBPE Capital has bought a minority stake in London-based Assisted Reproduction & Gynaecology Centre (ARGC).

FSI Régions backs Arcancil Paris MBO

FSI Régions has invested €500,000 in the management buyout of Arcancil Paris.

LDC buys Ocean Outdoor from Smedvig

LDC has completed the ТЃ35m buyout of UK digital advertising firm Ocean Outdoor from Smedvig Capital.

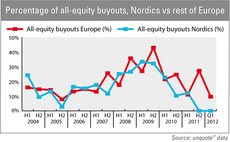

Nordic credit remains more readily available

The Nordic countries have enjoyed a lower proportion of all-equity buyouts than the rest of Europe for several months now - highlighting easier access to leverage in the region.

Invest AG set to buy Philips' Speech Processing unit

Invest AG, the private equity arm of Raiffeisen Banking Group Upper Austria, has agreed to buy Philips' Speech Processing unit.

Terra Firma in partial exit from Phoenix Group

Phoenix Group, a portfolio company of Terra Firma, has agreed to sell subsidiary Phoenix Supply to Northern Irish gas supplier Airtricity.

PEQ backs Inläsningstjänst MBO

PEQ has backed an MBO of educational services provider InlУЄsningstjУЄnst.

Baird acquires e2v technologies spin-off for £15m

Baird Capital Partners Europe has acquired the instrumentation solutions business of listed UK firm e2v technologies for ТЃ15m.

HgCapital completes financing for Wandylaw wind project

HgCapital has completed the financing for a 20.5MW wind project in Northumberland, England, in cooperation with its portfolio company RidgeWind.

Oxford Capital leads £2m round for BagThat

Oxford Capital Partners has led a ТЃ2m financing round for UK-based online shopping firm BagThat Trading.

Gimv sells stake in Belgian recruitment agency to Naxicap

Gimv has sold its minority stake in Belgian recruitment and selection agency Accent Jobs to Naxicap.

Swander Pace supports Cambrian Pet Foods

US private equity firm Swander Pace Capital has backed Welsh pet food firm Cambrian Pet Foods.

Clessidra and Avista acquire Rottapharm

Clessidra Capital Partners and Avista Capital Partners have acquired a 50% stake in Italian drugmaker Rottapharm from the founding family in a deal that values the business at €1.7bn, according to reports.

Permira's Telepizza to extend loans

Spanish pizza delivery chain Telepizza, backed by Permira, is asking lenders to extend the maturities of its loans, according to reports.

HTGF et al. inject €4.3m into Algiax Pharmaceuticals

High-Tech Gründerfonds (HTGF), private investors and promotional bank KfW have provided German biotech company Algiax Pharmaceuticals with a €4.3m seed funding round.

HTGF backs €1.45m t-cell round

High-Tech Gründerfonds (HTGF) has joined a €1.45m round for regenerative therapies developer t-cell Europe GmbH.