Deals

Buyout market could see worst year since 2009

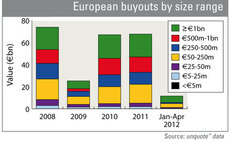

Latest figures show Europe's buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.

Buyout market could see worst year since 2009

Latest figures show Europe's buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.

Fouriertransform invests in ArcCore

Sweden-based venture capital firm Fouriertransform has invested SEK 10m in Swedish software developer ArcCore.

Primary Capital backs £35m MBO of Leisure Pass

Primary Capital has backed the ТЃ35m management buyout of London-based tourist pass systems provider Leisure Pass Group.

Bain Capital buys Bravida in tertiary buyout

Bain Capital has bought Swedish technical installation and services solutions company Bravida from Triton Partners in a tertiary buyout.

ISIS backs inov-8 with £12m

ISIS Equity partners has backed UK-based sportswear manufacturer Inoveight Holdings Limited with a total equity investment of around ТЃ12m, according to reports.

PE-backed Gala Coral to sell casinos for £205m

PE-backed Gala Coral has agreed to sell its UK casinos business to bingo and casino operator Rank for ТЃ205m.

Octopus-backed Zoopla aquires UpMyStreet

Octopus Venture Partnersт portfolio company Zoopla.co.uk has bought property information website UpMyStreet.com.

Endless acquires Bathstore

Turnaround investor Endless has bought UK-based bathroom retailer Bathstore from Wolseley for an estimated ТЃ15m.

Dry powder will drive 2012 dealflow - Bain

Extensive dry powder, few exit opportunities and tough fundraising conditions will be the major drivers of private equity globally, according to Bain & Company.

Pinova buys Norafin Industries in MBO

Pinova Capital has acquired German speciality textile producer Norafin Industries from MAJ Invest’s holding company Vernal.

Buyout market could see worst year since 2009

Latest figures show Europe’s buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.

DFJ Esprit leads $7m series-B for Moviepilot

DFJ Esprit has led a $7m series-B financing round for movie recommendation and discovery platform Moviepilot.

Endless buys Cinesite

Turnaround investor Endless has acquired a 60% stake in London-based visual effects company Cinesite from Kodak.

Hands puts personal cash in Terra Firma fund

Guy Hands has pumped £20m of his own money into Terra Firma’s current fund, according to reports.

Omnes et al. inject €12m into EXOSUN

Omnes Capital (formerly Crédit Agricole Private Equity) has taken part in a €12m funding round for French renewable energy business EXOSUN.

Balderton leads £10m series-C for MedicAnimal

Balderton Capital has led a ТЃ10m series-C financing round for online pet supplies retailer MedicAnimal.com.

Omnes and Demeter exit Methaneo

Omnes Capital (formerly Crédit Agricole Private Equity) and Demeter Partners have sold their joint 60% stake in Methaneo, a French developer of bio-methanisation solutions, to trade player Séchilienne Sidec.

Emertec and CDC Climat in €3m round for HPC-SA

Emertec and CDC Climat have invested €3m in French energy measurement software developer HPC-SA.

Litorina exits Tolerans

Litorina has divested Swedish stitching systems company Tolerans to CEO Jan Melin and a consortium of investors.

AXA PE invests €330m in Enovos

AXA Private Equity has acquired a 23.48% stake in Luxembourg-based utility company Enovos from ArcelorMittal for €330m.

eCAPITAL invests in HTGF portfolio firm Smart Hydro Power

eCAPITAL has led a €2.7m capital increase for High-Tech Gründerfonds (HTGF) portfolio company Smart Hydro Power.

Terra Firma's Infinis acquires three UK wind farms

British renewable power generator Infinis, a portfolio company of Terra Firma, has acquired a portfolio of three onshore wind farms from Broadview Energy Limited.

Governments' contribution to VC up six-fold

Government agencies and corporates are increasingly active in venture – but they should push further in support of European VC, argues Olivier Marty