Deals

Literacy invests in Tyrefix

Literacy Capital generally invests in companies with EBITDA of ТЃ1-5m and is sector-agnostic

IK buys majority stake in GeoDynamics from Sofindev

Sofindev had reportedly been looking to sell its 50.1% in the company and had mandated EY for the process

Altitude exits Mortec Semiconductor for 12.6x return

Altitude acquired the company in July 2016 in a deal that valued the company at around ТЃ1m

Capvis buys Arag

GP invests in the company via Capvis Equity V, which held a final close on €1.2bn in September 2018

Vesalius Biocapital leads €50m round for CatalYm

VCs including Forbion, BioGeneration Ventures and Coparion also back the immunotherapy developer

MCH sells Lenitudes, invests in Atrys

Sale ends a six-year holding period for MCH, which acquired a 66.5% stake in Lenitudes via its third fund

Via Equity invests in ESmiley

Deal is the GP's first from its fourth fund, which held a first close last month and is targeting тЌ175m

Ufenau to acquire Mac IT-Solutions

Ufenau intends to build an e-commerce software platform via a buy-and-build strategy

MIG leads €39m series-A round for IQM

"Deep tech" startup has so far raised тЌ71m since being founded in 2018

Auctus buys Landbäckerei Sommer from SIP

SIP acquired the bakery chain in 2011 and has made returns of more than 20x its total investment

DeA Capital buys Gastronomica Roscio

This is the first deal inked by the GP via Taste of Italy 2, which recently held a final close on €330m

Tikehau leads €150m investment in Amarenco

Pierre Devillard and Pierre Abadie from the private equity team of Tikehau will join the board

Novalpina buys majority stake in Laboratoire XO

Deal reportedly values the company at more than €300m, and unitranche debt was provided by debt fund manager Ares

Livingbridge invests in Visualsoft

Livingbridge invests through its Enterprise 3 fund, which closed on ТЃ334m in October 2019

KCP invests £7m in Darts Corner

Key Capital Partners had been tracking the company for two years prior to investment

Innova acquires stake in Bielenda Kosmetyki

Proceeds from the investment will fund the company's acquisition of two cosmetics brands from Norwegian cosmetics group Orkla

Bridgepoint buys minority stake in Diagnostiskt Centrum Hud

GP will help the company's expansion further into the Nordic region

HTGF et al. lead €2m round for All3DP

Company intends to launch an international financing round, which is scheduled for 2021

Lea Partners sells IDL to PE-backed Insightsoftware

Lea acquired a majority stake in the financial performance enterprise software business in 2019

PAI acquires LDC's Addo Food and Equistone's Winterbotham Darby

Both management teams have reinvested and operations will continue to be run separately

SoftBank leads $250m round for Tier Mobility

VCs including Mubadala Capital, Northzone and RTP Global also back the e-scooter startup

EQT sells Tia Technology to trade

GP is selling the company for $78m in cash on a fully diluted basis, six years after acquiring it

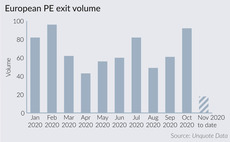

Private equity ramps up divestment efforts

Exit activity jumped by 50% in October, back to pre-pandemic levels, according to Unquote Data

LDC sells Babble to Graphite for £90m

LDC retains a minority stake in Babble, while the management team is reinvesting some of its proceeds