Funds

Siparex raises €110m on way to €150m target

French mid-cap investor Siparex has already raised €110m for its MidMarket III fund, which held a €90m first close in September.

Top 5 largest funds of all time

Last week, Advent International raised one of the biggest private equity funds investing in Europe in recent years, but how does it compare with the largest funds of all time?

Viveris Croissance IV holds first close on €30m

Viveris Management has held a first close of its fourth fund on €30m.

JPEL aims to boost price with share buyback

J.P. Morgan Private Equity Ltd (JPEL) has completed a $20m coordinated share repurchase programme as part of the firm's recently announced strategic initiatives to lift the price of its shares.

EIF commits €20m to Aster Capital cleantech fund

The European Investment Fund has committed €20m to the French cleantech venture fund Aster II.

La Caixa launches new €23m fund

Spanish bank La Caixa has launched its new fund, Caixa Innvierte Industria, which attracted €23m in commitments and will be managed by Caixa Capital Risc, according to reports in the Spanish press.

Apollo officially launches new $12bn fund

Global private equity house Apollo Global Management has started marketing its eighth buyout fund with a $12bn target, co-founder Josh Harris announced during a presentation at the Bank of America Merrill Lynch Banking and Financial Services conference...

Advent raises €8.5bn for fund VII

Advent International has raised €8.5bn for its latest fund, Advent International GPE VII LP, in less than nine months.

EQT Credit II hits €376m

Swedish private equity house EQT has raised тЌ376m for its second credit opportunities fund, according to reports.

DACH leads quiet Europe in Q3

DACH on top

Elaia Partners launches seed fund

French growth capital specialist Elaia Partners is understood to have secured €45m of commitments for its new seed vehicle Elaia Alpha.

ADCURAM closes first fund on €150m

ADCURAM Group has held a final close on its maiden fund, amounting to around €150m.

Spanish government to launch new VC fund

The Spanish government will announce the launch of a new VC fund to back technology startups next week, according to reports in the local press.

Nordic Capital cuts LBO fund target by 25%

Nordic Capital has told investors it will cut the original тЌ4bn target of its latest leveraged buyout fund by 25%, according to reports.

Nesta launches £25m impact investment fund

Nesta Investment Management, a subsidiary of innovation foundation Nesta, has launched a ТЃ25m impact investment fund, holding a first close on ТЃ17.5m.

Albion launches top-up fund for six VCTs

Albion Ventures has started fundraising for a top-up fund targeting six of its VCTs, aiming for a total of ТЃ15m.

GED buys own portfolio with tail-end fund

GED has raised a secondary tail-end fund that has acquired the portfolio of its first Iberian fund, GED Iberian.

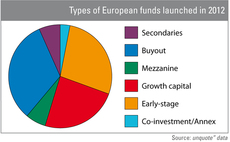

Secondaries and mezzanine vehicles proving popular in 2012

Looking at the funds launched so far this year in Europe shows sustained appetite for mezzanine and secondaries vehicles, reflecting current investment opportunities and subsequent LP interest for the private debt and secondaries markets.

Palio plans £150m debt fund IPO

Debt fund Palio is planning an IPO to raise more than ТЃ150m for investment in debt opportunities for UK lower mid-market companies.

Creathor Venture III holds final closing

German VC Creathor Venture has held a final close for its third fund on €80m.

DACH PE Congress: Sourcing in a low-growth environment

With the eurocrisis overshadowing any economic and fiscal concern on the continent, GPs have to rethink how to successfully source deals and impress investors to secure commitments for future funds. Anneken Tappe reports from the unquote” DACH Private...

360 Capital holds first closing of venture fund

Venture investor 360 Capital Partners has held a first close on its second fund, 360 Capital 2011, on more than тЌ60m.

Kibo launches €45m fund

Kibo Ventures has launched a €45m fund to back internet and mobile start-ups, and held a first close on €42m.

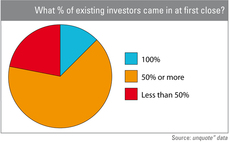

Fundraising research reveals optimism in tough times

Despite talk of apocalyptic investor behaviour, most GPs announcing a close this year reported existing LPs re-upping Т and even increasing ticket sizes, as revealed in an unquote" survey of more than 40 European GPs. Anneken Tappe reports