Funds

Elbrus Capital Fund II gets $50m injection from EBRD

The European Bank for Reconstruction and Development has agreed to invest up to $50m in Russia-based Elbrus Capital Fund II.

Cherie Blair's PE fund raises £4.5m towards £75m target

Allele, a healthcare-focused private equity fund set up by Cherie Blair, is understood to have raised 6% of its ТЃ75m target.

Latvian Guarantee Agency seeks managers for local VC funds

State-backed Latvian Guarantee Agency (LGA) has launched a tender to select up to three managers for recently established VC funds.

NorthEdge hits £125m first close

Manchester-based lower mid-market investor NorthEdge Capital has hit a first close on ТЃ125m for its maiden fund, according to sources close to the firm.

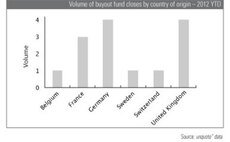

Competition heats up for German fundraising

Deutsche Beteiligungs AG (DBAG) last week closed Germany’s biggest fund since 2007. While the country’s fundraising environment has been paid little attention in recent years, it has seen as many fund closes in 2012 as the UK. John Bakie investigates...

Star Capital SGR holds first closing

Italian investor Star Capital SGR has held a first closing on more than €70m for Star III, a fund aiming to back Italian SMEs.

Inveready launches €15m technology fund

Spanish investor Inveready has launched a €15m fund to back technology companies.

Main Capital holds €12m first close for third fund

Main Capital Partners has held a €12m first close for its Main Capital III fund, launched in September 2011.

DBAG VI hits €700m hard cap

Deutsche Beteiligungs AG (DBAG) has closed its sixth fund at €700m, breaking its target and reaching its hard cap.

Summit Partners raises $520m credit fund

Summit Partners has raised a $520m credit fund for middle-market companies, far surpassing its original $300m target.

Spain's CDTI to launch two venture vehicles

Spain’s Centre for the Development of Industrial Technology (CDTI) will soon launch two venture capital vehicles with capital commitments totalling €150m, according to reports in the Spanish press.

Inflexion closes £100m co-investment fund

Inflexion Private Equity has closed its 2012 Co-Investment Fund on its ТЃ100m hard cap, six weeks after sending out PPMs.

Evonik invests in Pangaea Ventures fund

CVC-backed German speciality chemicals maker Evonik has invested in Pangaea Ventures Fund III through its recently established venture unit.

Fondo Italiano provides capital to Hat Holding

Fondo Italiano di Investimento has committed capital to Italian investment company Hat Holding, allowing the firm to shift its focus from club deals to investments from a closed-end fund.

Equita CoVest in €115m first close

Equita Management has held a €115m first close for its Equita CoVest fund.

EIF commits €17m to Lithuanian SME funds

The European Investment Fund (EIF) has committed тЌ11m to the Practica Venture Capital Fund and тЌ6m to the Practica Seed Capital Fund.

Rothschild closes first European secondaries fund on €259m

Rothschild has held a final close for its Five Arrows Secondary Opportunities III (FASO III) fund, exceeding its initial target of тЌ200m.

Akina holds first close on €173.5m

Akina Partners has held a first close for its fifth fund-of-funds, Euro Choice V, on тЌ173.5m.

Will Luxembourg lose prime spot as fund domicile?

Luxembourg losing out?

Coller's sixth fund hits $5.5bn final close

Coller Capital has held a final close for its sixth fund on $5.5bn, exceeding its original $5bn target.

RiverRock closes European SME fund on €169m

RiverRock European Capital Partners has announced the final close of its European Opportunities Fund on тЌ169m.

Castle PE shareholder battle intensifies

Castle Private Equity’s battle with its shareholders has intensified after activist investor Abrams Capital became its largest investor.

BV Capital rebrands as e.ventures

Global venture firm BV Capital has combined its five local funds into a unified international entity named e.ventures.

Bain kicks off fundraising for new $6bn vehicle

Bain Capital is understood to have started the fundraising process for its 11th buyout fund, Bain Capital Fund XI.