Fundraising

Pledge funds not a panacea, says SJ Berwin's Sonya Pauls

Speaking at the annual unquote" CEE Private Equity Congress in London today, SJ Berwin partner Sonya Pauls highlighted the advantages of the currently popular deal-by-deal fundraising model, but also warned about its shortcomings.

Fundraising tales reveal market split

The post-crisis fundraising market may be deemed one of the toughest ever, but not all GPs can rely on the same formula to succeed, as Chequers Capital and Blackfin Capital Partners explained at the annual AFIC conference in Paris last week. Greg Gille...

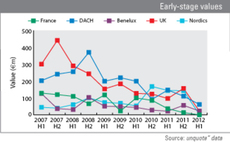

Declining activity belies venture successes

Although European venture capital activity decreased by 12% to €974m last year, 2011 saw a number of sizeable fund closes as well strong exits, indicating fresh appetite for the asset class.

LBO France delays fundraising effort

French mid-cap GP LBO France has pushed back the launch of its next €1.5bn White Knight IX vehicle - which was supposed to take place in Q1 - to Q3 2012, according to French publication Capital Finance.

Bank investments in PE down 69%

Anecdotal evidence highlights that PE houses cannot rely on banks and insurance companies to raise the bulk of their funds anymore. Data from French association AFIC backs this up with worrying numbers. Greg Gille reports

£14bn raised: but how to spend it?

European fund closes totalling nearly €14bn have been announced in the past fortnight. Deal data suggests it may be a bit much, and that not all are equipped to manage it. Kimberly Romaine reports

Fifth Cinven fund holds first close at €3bn

Cinven has held a тЌ3bn first close for its fifth fund.

Private equity could profit from QE threat to sovereign bonds

According to the National Association of Pension Funds (NAPF), quantitative easing efforts depress ROI of pension funds committed to gilts, which could push them towards alternative assets.

Quilvest closes two funds, launches new FoF

Global private equity manager Quilvest has raised in excess of $300m across two vehicles and is marketing a new $200m fund-of-funds.

GP commitments: PE houses feel the pressure

More than 80% of GPs are feeling pressure to up personal commitments to their funds, according to research by Investec.

Palio Capital Partners raising debt fund for UK SMEs

Palio Capital Partners has secured a cornerstone investment from the European Investment Fund, raising a third of its anticipated ТЃ100m first close.

Duke Street shelves €850m fundraising plans

Mid-cap GP Duke Street has abandoned plans to raise a €850m vehicle, instead turning to a deal-by-deal fundraising model.

Italian sentiment: fundraising, leverage largest challenges

A recovery for the Italian market is not expected until 2013 at the earliest, according to a recent poll - but the backdrop brings with it fresh prospects.

Fund T&Cs: Tailored fit

With many GPs currently hitting the fundraising trail – and many more to come – should terms and conditions follow a gold standard to attract investors? Greg Gille investigates

Carlyle spin-out Resource doubles fund in top-up

The appeal of a handful of firms belies the dearth of LP appetite for private equity.

AtriA spinout a precursor for 2012?

Edouard Thomazeau and Thibaut de Chassey - two former partners at French GP AtriA Capital Partenaires - have launched a new mid-cap firm. De Chassey talks to Greg Gille about the firm’s strategy and its experience of a tough fundraising market.

Navigating a fundraise

Forget much of what youтve learned. Wooing LPs nowadays follows few preconceived truths, requiring instead a lot of patience and creativity. Kimberly Romaine reports

France Télécom and Publicis launch €300m VC fund

French companies France Télécom and Publicis intend to jointly commit €150m to a new venture capital fund focusing on internet businesses.

GPs targeting larger funds - study

Around two fifths of GPs believe that their next fund will be larger than the current one, according to research from Investec.

Abacus acquires Portal Fund Administration

Abacus has acquired Isle of Man-based Portal Fund Administration Limited, expanding its service capacity.

Fundraising evolves for a difficult climate

While public financial markets remain punch drunk from the latest series of downgrades, debt crises and bailouts, private equity has, by necessity, been slowly emerging from one of its most difficult periods.

DACH Congress: Fundraising targets €7bn

Despite a sombre economic backdrop, DACH private equity deal doers are remarkably upbeat, with two thirds of todayТДs unquote" Congress in Munich convinced that LP appetite for the region is actually rising.

NIBC Bank spin-off holds €100m first close

Avedon Capital has held a first close of its NIBC Growth Capital Fund II at €100m.

unquote" summit: 75% of historical LP base impacted by regulation

Greg Gille reports direct from unquote's 20th anniversary private equity summit in London.