Fundraising

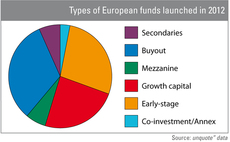

Secondaries and mezzanine vehicles proving popular in 2012

Looking at the funds launched so far this year in Europe shows sustained appetite for mezzanine and secondaries vehicles, reflecting current investment opportunities and subsequent LP interest for the private debt and secondaries markets.

German funds: The LPs' verdict

LP verdict

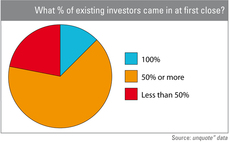

Fundraising research reveals optimism in tough times

Despite talk of apocalyptic investor behaviour, most GPs announcing a close this year reported existing LPs re-upping Т and even increasing ticket sizes, as revealed in an unquote" survey of more than 40 European GPs. Anneken Tappe reports

Video: David Currie - industry needs liquidity

As he steps down from 33 years in private equity, most recently with SL Capital, David Currie shares his views on the industry's future.

Distributions to LPs exceed calls in H1

Distributions to LPs have exceeded new calls in the first half of 2012, according to research from Triago.

Top 5 final closes of 2012 so far

Fundraising

Cathay Capital wins €150m Franco-Chinese mandate

French state-backed Caisse des Dépots et Consignations and the China Development Bank have co-funded a €150m investment fund to be managed by Franco-Chinese GP Cathay Capital.

Telefónica launches €300m network of VC funds

Telefónica Digital Venture Capital, the venture subsidiary of Spanish telecommunications firm Telefónica, has launched a €300m network of venture capital funds named Amérigo.

LDC pumps £20m into restaurant fund

UK-based GP LDC has invested ТЃ20m in Hill Capital Partners LLP's new restaurants-focused vehicle.

CEE fundraising up 50% to €1bn

Almost €1bn was raised by CEE-focused funds in 2011, up almost 50% from the previous year, according to EVCA.

Voting ends today: British Private Equity Awards 2012

British Private Equity Awards

Would the real CEE please stand up?

Confusion over CEE stats

Latvian Guarantee Agency seeks managers for local VC funds

State-backed Latvian Guarantee Agency (LGA) has launched a tender to select up to three managers for recently established VC funds.

Video: Natural attrition of GP relationships to accelerate – Capital Dynamics' Katharina Lichtner

Video: Capital Dynamicsт Katharina Lichtner

AIFMD having little impact on fund marketing

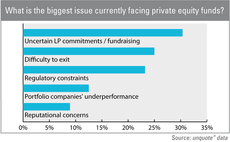

More than half of GPs say the Alternative Investment Fund Managers' Directive (AIFMD) has had little impact on their marketing activities with just a year to go until implementation, according to a survey by IMS Group.

Video: Jonathan Blake advises on fundraising

Video: Jonathan Blake

French fundraising: Out in the wild

French fundraising

EQT raises €1bn for infrastructure fund

EQT has raised more than тЌ1bn for its second infrastructure fund, reports suggest.

Fundraising a chief concern for Nordic PE professionals

While the AIFM Directive was on everybody's agenda last year, fundraising is the main concern for most of the private equity practitioners polled in the latest unquote" Nordic Survey.

The Nordic coming-of-age

The Nordic coming-of-age

Triago's Dréan launches online PE marketplace Palico

Palico, a global online marketplace for the private equity fund community, launched yesterday.

CVC Capital Partners said to raise €10.75bn fund

CVC Capital Partners is in the process of raising a new Europe-focused fund targeting €10.75bn ($13.5bn), reports suggest.

Dry powder will drive 2012 dealflow - Bain

Extensive dry powder, few exit opportunities and tough fundraising conditions will be the major drivers of private equity globally, according to Bain & Company.

Fundraising activity up by 80% in 2011

European private equity and venture capital fundraising increased by 80% in 2011, according to recent figures released by EVCA.