Fundraising

Solvency II: Doubts cast over private equity risk measures

The scramble for cash among GPs is set to heat up as they prepare for another reduction in capital allocations т this time from European insurers - as regulators work on plans forcing them to hold additional cash as a buffer against private equity risk....

Augmentum Capital announces formal launch

Augmentum Capital has formally launched its fund today, looking to invest £50m in private equity investments over the next three years.

Partners Group closes mezzanine fund on €553m

Swiss-based Partners Group has closed its mezzanine fund Partners Group European Mezzanine above target at тЌ553m. The fund attracted investments from corporate and public pension plans, insurance companies, financial institutions, endowments as well...

Astorg to raise €1bn buyout fund

Media reports suggest that the French mid-cap buyout house Astorg is planning to raise a €1bn buyout fund this year.

Southern Europe unquote" May 2010

Figures from the recently published unquote” Private Equity Barometer, produced in collaboration with Candover, indicate that there was good news in the form of an increase in the aggregated value total, though the modest 2.6% rise from €10.3bn to €10.5bn...

Trend report: Nordic PE/VC in 25 years

To celebrate SVCAтs 25-year anniversary, the SVCA and Nordic unquoteт set out to see what the industry itself expects from the next quarter of a decade.

Recovery fund: releasing the shackles of debt

ICGтs new recovery fund specifically supports companies chained down by over-leverage, rather than loss-making businesses that require a complete turnaround. Francinia Protti-Alvarez investigates

Fundraising: Unlocking LP appetite

Fundraising in the current environment can feel like facing a series of closed doors, but there are ways of unlocking LP commitments. Julian Longhurst reports

HarbourVest to list shares on LSE

HarbourVest Global Private Equity has announced plans to list its shares on the Specialist Fund Market of the London Stock Exchange.

unquote" 6 April 2010

LP/GP relationships are changing like never before as investors push for improved terms and increasingly look to bypass GPs and invest directly.

Gimv-XL closes on €609m

European investment company Gimv has announced the final closing of its latest vehicle Gimv-XL fund at €609m.

Fundraising set for 2010 uptick after defiant year

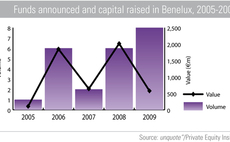

According to figures to be published in the upcoming European Fundraising Review 2010, fundraising in the Benelux region has remained resilient in 2009 in spite of the downturn.

Candover's shares rise as firm hints at new beginnings

Troubled private equity firm Candover's shares went up 8% in early morning today after it reportedly hinted at future plans to raise new funds.

LPs throw out the old for the new

It is now common knowledge that fundraising for private equity funds this year will be tough to say the least. Many, however, do not realise just how tough. News reports this week suggest that LPs are now considering severing ties with some GPs altogether...

Q&A: Fundraising in 2010 and beyond

Charlie Jolly principal at Matrix talks to Francinia Protti-Alvarez about recent fundraising trends and implications for the future.

Q&A: The fundraising fulcrum

Francois Rowell speaks to Mounir Guen, CEO of placement agent MVision, about the fundraising climate in 2010.

Secondaries players to fill later-stage gap

A lack of LP appetite has left a void at the later-stage end of the European venture market. Could secondaries players hold the key, asks Emanuel Eftimiu

Change in attitude needed for future fundraising

New stats reveal 5-year low in fundraising; co-investing needed to lure LPs. By Emanuel Eftimiu

unquote" Fund Administration Report 2009

An introduction to the fund administration market

Impotent Revolution

Changes to fundraising terms in 2010

European Fundraising Review

The essential guide to fundraising in Europe

Balance of power

Investors are putting a significant amount of pressure on buyout houses, pushing for better terms and in some cases scaling back commitments

EUROPE - Partners Group's Global Opportunites fund moves listing to Ireland

Partners Group's Global Opportunites investment fund has altered its status from a closed-end vehicle to an open-ended vehicle and has delisted from the London Stock Exchange in prepartion for shifting its shares to the Ireland Stock Exchange, due to...