Fundraising

VC fundraising enjoys strong 2020 vintage, sunny prospects

With record amounts of capital raised for the strategy, venture capital fundraising does not appear to have been slowed by the pandemic

Heritage funds: Large-cap players explore mid-cap opportunities

With Astorg on the road, and Triton and PAI having closed smaller funds this year, Unquote looks at what is driving the trend

Waterland secures €500m ESG facility for eighth fund

ABM Amro, Rabobank and Natixis arrange the facility for the GP's €2.5bn latest fund

Unquote Private Equity Podcast: First-time fortunes

Vincent Van den Brink and Greg Kok from fund administrator JTC discuss how recent months have affected the fortunes of first-time funds

KKR gears up for sixth European fund

GP's predecessor vehicle closed in 2019 on €5.6bn and was 41% deployed as of December 2020

Apposite heads for autumn final close for third fund

Healthcare-focused GP has made its first deal from the fund, acquiring Switzerland-based 1Med

Digital+ Partners gears up for fundraise

GP focuses on later-stage B2B technology companies and closed its previous fund in 2018 on €350m

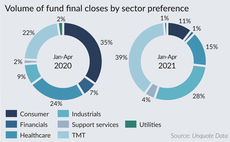

PE funds raised in pandemic increasingly target TMT opportunities

GPs' origination preferences and 2020 investment volume have already shown a clear shift to technology investments, with new fundraises following suit

Andera Partners lines up DACH expansion plans

Starting with BioDiscovery 6, the GP intends to accelerate fundraising and deal-making in the region

Fundraising fortunes: prevailing LP preferences persist

Alessia Argentieri looks at the winning strategies, and gathers insight from placement specialists as to what the rest of 2021 has in store

Quiet market for final closes in Q1, as backlog of funds on the road grows

The number of final closes for European PE funds was down by 22% year-on-year in Q1 2021

Q&A: do not give up on the lower-mid-market, says Monument's Karl Adam

Monument partner Karl Adam tells Greg Gille how an opportunity to break through still exists for lower-mid-market managers in a very top-heavy market

Astorg Mid-Cap anticipates summer final close

Fund will make pan-European investments in mid-market companies and has a €1bn target

Nordic Fundraising Pipeline - Q1 2021

Unquote rounds up notable fundraises ongoing across the Nordic market, including EQT, Axcel, CapMan, Saga, and more

UK & Ireland Fundraising Pipeline - Q1 2021

Unquote rounds up the most notable fundraises currently ongoing in the UK & Ireland market across the buyout, venture and debt spaces

UVC Partners set for Q2 2021 final close for third fund

UnternehmerTUM Fonds III is targeting €150m and held a first close in October 2020 on €108m

Target Global heads for Growth II final close

Fund will make series-B and -C investments; it has a target of тЌ400m and a hard-cap of тЌ600m

Gyrus Principal Fund to close in Q2 2021

Fund focuses on healthcare, technology and sustainability, and expects to close on its €400m hard-cap

Capiton heads for summer final close for sixth fund

Capiton VI has a €550m target; Capiton V held a final close in January 2015 on €440m

Earlybird heads for Growth Opportunities final close

European VC investor is also fundraising for its latest Digital West and Health funds

Majority of LPs happy to commit without in-person meeting – survey

Cebile Capital survey finds that 51% of respondents expect to increase PE commitments in 2021

Cipio Partners eyes March first close for eighth fund

Technology-focused investor's predecessor vehicle held a final close in July 2017 on €174m

Afinum back on road for ninth fund

Predecessor vehicle, which raised €410m in 2017, is now 86% deployed

HQ Capital registers HQ Capital IV GP

Luxembourg-domiciled legal structure will allow HQ Capital to launch its next funds in 2021 and 2022