Fundraising

Greenhill hires Silverfleet's Harrison

Andrew Harrison will advise on capital raising across entities including funds and co-investments

ArchiMed launches second mid-cap fund

Med Platform II will aim to make 8-12 investments in the mid-market, and will be larger than its EUR 1bn predecessor

Mizuho acquires placement agent Capstone

US investment bank intends to strengthen its service offering for financial sponsors

Azulis closes MMF 6 on EUR 280m

MMF 6 is already 22% deployed, having invested in four companies in 2021

KKR closes USD 4bn healthcare fund

Health Care Strategic Growth Fund II is the successor to HCSG I, which closed in November 2017 on USD 1.45bn

Norvestor registers two funds

Nordic-focused GP has registered flagship fund Norvestor IX, as well as Novestor SPV II

2022 Preview: Sponsors toast to incredible year, but remain wary of hangover

Many sponsors are anticipating that 2022 could be just as busy as 2021, in spite of mounting headwinds

Nordic Capital registers latest flagship fund

Nordic Capital XI's registration follows the final close of its predecessor in 2020 on EUR 6.1bn

Average fund size reaches new heights amid stark market bifurcation

Average buyout fund close for 2021 stands at EUR 1.33bn, more than double the EUR 629m recorded in 2017

Bain gears up for sixth European buyout fund

US-headquartered GP held a final close for its previous European fund in 2018 on EUR 4.35bn

Riverside hires Cole as fundraising and IR head

Allison Cole was previously head of fundraising and investor relations at Lightyear Capital

Victus to come back to market in early 2022

Vehicle will pursue the same strategy as its predecessor, targeting mature agriculture- and food-related businesses

CapMan Wealth Services forms Investment Partners Fund

EUR 90m fund will invest in cooperation with AlpInvest, backing US mid-market funds chosen by the GP

Podcast: In conversation with... Sunaina Sinha, Raymond James | Cebile

The Cebile Capital founder discusses the tie-up with Raymond James, and the key trends at play in the global fundraising and secondaries landscapes

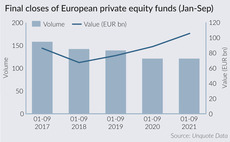

European GPs raise record amounts in first nine months of 2021

Raising EUR 105.5bn in aggregate commitments is a 30% increase on the average amount raised in comparable periods over the previous four years

GP Profile: Gyrus looks to next steps after debut pandemic fundraise

Co-founder Guy Semmens discusses the GP's first-time fundraise, its deal pipeline, and the lead-up to its next fund

Polaris heads for final close for fifth fund

GP made its fifth deal from the fund earlier in September, acquiring G&O Maritime Group

Podcast: In conversation with… Adam Turtle, Rede Partners

Turtle joins the podcast to discuss the firm's journey over its first decade and the main trends in the European fundraising landscape

Unquote Private Equity Podcast: H1 review special

The team looks at key takeaways and numbers across deal-doing and fundraising, and ponders where the market might be headed

Silverfleet calls off fundraise for third fund

GP intends to focus on follow-on investments and realisations in its existing portfolio

Fundraising Report 2021: mapping out the post-Covid landscape

Unquote analyses key trends and presents proprietary data on the European fundraising market

British Patient Capital launches £600m life sciences programme

Programme will invest in later-stage life sciences funds targeting at least ТЃ250m

High-Tech Gründerfonds to launch fourth seed fund

Fund expects to launch its official fundraising process in September 2021, subject to BaFin approval

Unquote Private Equity Podcast: Fundraising full steam ahead

With record amounts of capital raised in 2020 and a roaring start to 2021, it seems not even a pandemic could slow the momentum of PE fundraising