Quiet market for final closes in Q1, as backlog of funds on the road grows

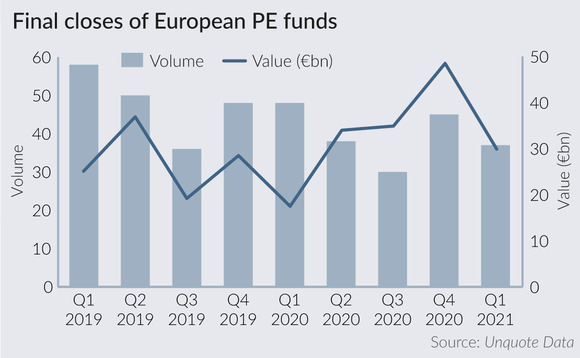

The number of final closes for European private equity funds was down by 22% year-on-year in Q1 2021, according to Unquote Data, while new launches and registrations also slowed down.

Unquote recorded 37 final closes of PE funds managed by European GPs (excluding credit and infrastructure funds) in the first quarter of 2021, gathering aggregate commitments of €29.9bn.

This is among the quietest quarters for final closes in recent years, second only to Q2 2020's 30 closes. By comparison, Unquote recorded 45 final closes in Q4 last year, 48 closes in Q1 2020 and 58 closes in Q1 2019.

The aggregate commitments of Q1's closes, at €29.9bn, are more in line with recent quarterly averages, bearing in mind such figures are regularly skewed by the timing of mega-fund closes. Indeed, more than half of Q1's total is attributable to just two final closes: Apax X closed on $11bn in January and Coller International Partners VIII held a final close on $9bn that same month.

Largest European final closes (Q1 2021)

| Name of Fund | Fund Manager | Country | Fund Type | Amount raised (€m) |

| Apax X |

Apax Partners |

UK | Buyout | 9,584 |

| Coller International Partners VIII |

Coller Capital |

UK | Secondaries | 7,368 |

| Bregal Unternehmerkapital III |

Bregal Unternehmerkapital |

Germany | Buyout | 1,875 |

| T2 Energy Transition Fund |

Tikehau Capital |

France | Buyout | 1,100 |

| PAI Middle Market Buyout Fund |

PAI Partners |

France | Buyout | 920 |

| Triton Smaller Mid-Cap Fund II |

Triton Partners |

Germany | Buyout | 815 |

| Norvestor VIII |

Norvestor Equity |

Norway | Buyout | 800 |

| Capital Dynamics Global Secondaries V |

Capital Dynamics |

Switzerland | Secondaries | 638 |

| KLAR Partners I |

Klar Partners |

UK | Buyout | 600 |

| Agilitas 2020 Private Equity Fund |

Agilitas Partners |

UK | Buyout | 565 |

Source: Unquote Data

With 19 events recorded in Q1 2021, first closes were also down on both the previous quarter (24 closes) and Q1 2020 (37 closes). Meanwhile, as reported, fewer funds were launched in the first quarter than in any quarter in 2020: Unquote recorded eight fund launches between January and March this year, to which can be added 18 vehicles filing for registration in anticipation of a formal launch.

Highlights of fund launches in Q1 this year have included Apax Digital Fund II, which came to market with a target of $1.5bn and is expected to close in Q2; and Afinum 9, which is targeting €450-500m and expects to hold a first close by mid-year.

That said, the European fundraising pipeline remains crowded, with no fewer than 205 vehicles launched since 2019 and still on the road.

In addition, a number of processes were delayed by the pandemic, with some GPs opting to wait it out for a few months before coming back to market with their next vehicle. It is therefore likely that the tempo of new launches and pre-marketing efforts will ramp up as the year progresses, as highlighted in our most recent Fundraising Pipeline round-ups.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds