PE funds raised in pandemic increasingly target TMT opportunities

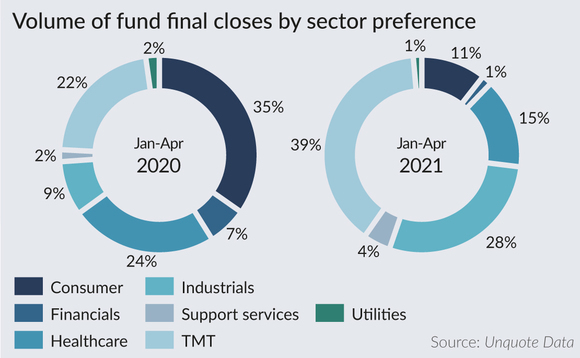

Nearly 40% of European private equity funds closed between January and April this year will actively seek investments in the TMT sector, compared with 22% of the funds closed during the same period in 2020, according to Unquote Data.

Note: the breakdown of sector preferences in the chart above is not exclusive; one fund can have several sector preferences.

The shift to technology opportunities may have come at the expense of the harder-to-navigate consumer segment, with just 11% of funds closed in the first four months of 2021 expressing a clear focus on the sector. By comparison, 35% of the vehicles closed between January and April 2020 had consumer as one of their preferred sectors.

The appetite for industrial assets has held up much better than one might have expected, though: more than a quarter (28%) of the funds closed in early 2021 will actively consider investments in the space.

The shift towards technology-focused investments (even when the assets in question sit in a more traditional industry such as consumer or industrials) has been one of the key talking points of recent months in the PE space. "The pandemic has accelerated the shift towards sector specialisation across Europe, something that we have already seen in the larger US market," Marc Wursdorfer, head of UBS's private funds group, told Unquote in April. "In 2020, we saw generalist funds become much more multi-sector-focused, and other managers that had already embraced the road towards specialisation accelerate and optimise this trend, taking a much deeper focus on certain industries."

Numerous players that have historically had a much broader horizon have now started to narrow down their scope, specialising predominantly in areas like technology – particularly software and tech businesses with strong recurring revenues – as well as healthcare and some resilient healthcare-related segments.

This has translated to the deal-doing side, too. A quarter (26%) of all buyouts inked in the past 12 months in Europe targeted assets in the technology sector, according to Unquote Data. Looking at the 2017-2019 period, that proportion stood at just 15%.

As previously reported by Unquote, the number of final closes for European private equity funds was down by 22% year-on-year in Q1 2021, according to Unquote Data, while new launches and registrations also slowed down.

But the pace of final closes has since picked up, with Unquote recording 21 closes in April and early May alone (compared with 36 for the whole of Q1). The previous quarter's aggregate commitments have also been matched already, given that April saw the closes of two mega-funds: EQT held a final close on €15.6bn for its ninth buyout fund, exceeding its target of €14.75bn, while Ardian held a final close for its seventh buyout fund on €7.5bn.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds