Investments

Deal in Focus: NVM injects £2m into Lending Works

Peer-to-peer lending platform is to undertake a recruitment drive

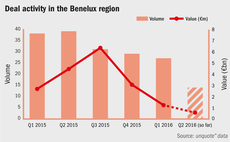

Benelux: alternative lenders to the rescue

With Benelux deals on the wane, could more flexible financing methods unclog the region's private equity market?

German PE develops a growing appetite for startups

VCs including Earlybird's Brandis discuss the growing trend of private equity houses taking part in growth capital deals within the country

3i in DKK 1.5bn bid for BoConcept

GP has acquired 67.5% of furniture companyтs share capital and 81.5% of voting rights

Usual suspects working hard in sedate Benelux market

Trend of declining dealflow in the region shows little signs of change, though buyout multiples return towards lower long-term averages

British investors hold fire as EU vote looms

Dealflow and aggregate value drops to 2009 levels as uncertainty puts private equity firms' plans for UK investments on hold

Goldman Sachs-backed Dong prices IPO at up to DKK 106bn

Energy company will make Danish financial market history as largest-ever listing

VC financial engineering fuelling tech bubble?

Downside protection in later VC-backed funding rounds is increasingly presented as justification for growing valuations

Bruno Bézard named managing partner at Cathay Capital

Frenchman makes radical career change, moving on from position within France's Public Finances

Cast adrift: What next for PE-backed oil & gas companies?

Exit opportunities for funds exposed to the oil & gas market have been severely impacted by the drastic drop in oil prices over the past two years

LBO France moves into VC with Innovation Capital purchase

LBO France takes over Innovation Capital's investment vehicle Sisa with €68m in commitments

Deal in Focus: Montagu acquires August's FSP

Tertiary buyout will pave the way for further consolidation of the funeral services market, which has proven highly popular among PE players

Comment: The impact of lifting Iranian sanctions on private equity

The lifting of international sanctions has opened Iranian borders to European investors, but the gates are still not fully open

Q1 Barometer: Slow start across Europe despite French uptick

The European buyout segment witnessed a slow Q1 volume-wise, with the number of deals recorded being the lowest total since Q1 2014

Deal in Focus: Telepizza listing leads southern Europe IPO wave

An in-depth look at Telepizza’s listing on the Spanish stock exchange

Navigating the complex world of co-investment

unquote" gleans insight from Capital Dynamics' David Smith on the intricacies of co-investment

PE and the 4th Industrial Revolution: Blurring the lines

Part four: with an increasing number of VC-backed tech unicorns, private equity players are changing the face of later-stage funding rounds

PE and the 4th Industrial Revolution: The new deal

Part three: is private equity waking up to the realities of investing in companies at the forefront of the Fourth Industrial Revolution?

Deal-by-deal emerges as contender to fund-based investing

LP appetite for co-investment has led to the increasing popularity of the deal-by-deal approach; we assess two GPs that have employed both strategies

Deal in Focus: Silverfleet's sale of Kalle proves viability of SBOs

CD&R becomes the sausage casing producer's fifth institutional owner as GPs are increasingly feeling the need to deploy their dry powder

Another bumper year for VCT fundraising despite rule changes

VCT funds have pulled in record amounts this year, but how easily will deployment be given recent rule changes?

Deal in Focus: Advent unlocks Spain's troubled housing market

An in-depth look at Advent’s €350m exit of Tinsa in the difficult Spanish property market

Invoice discounting attracts growing private equity investment

As GPs become increasingly comfortable with alternative lending, those serving the small-cap market are gaining attention too

Electra commits £19m to CVC's new CLO

Commitment forms part of the debt element of Electra's investment strategy