Investments

Deal in Focus: Kartesia supports ProFagus expansion

Alternative lender bets on its existing network in locating German deals, as it supplies a debt replacement package for Steeadfast-backed ProFagus

Deal in Focus: Riverside acquires panel-door maker Epco

GP is planning an international expansion strategy for the panel manufacturer, with a particular focus on central and eastern Europe

Macquarie, Prime's Takeaway.com valued up to €1.1bn in IPO

The PE-backed company expects to raise €350m from public offering

European entry multiples rebound in Q2

Following a dip in Q1, multiples for European PE-backed buyouts have returned to 2015 levels

Deal in Focus: HIG divests maiden Italian education buyout

An in-depth look at the firm’s first private equity investment in the education sector in Italy

Polish buyouts keep CEE afloat

Poland has established itself as the largest buyout space in CEE

Advent, Bain and ATP to float Nets

IPO aims to raise around DKK 5.5bn for the company and investors

ECI finds UK high-growth firms want single-market access

Research from the private equity firm finds 82% of respondents want access to the EU single market

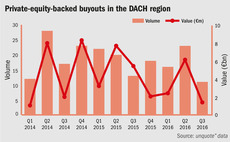

DACH buyout dealflow hits 15-month high in Q2

Buyout volume and aggregate value were up by 43% and 155%, respectively

Byron disaster puts PE on the grill

While many observers criticised the burger chain's role in deporting employees, the controversy raised questions of its private equity owners

Europe's top five summer buyouts

unquote" lists the five largest buyouts to have taken place so far this summer across Europe

French dealflow holds steady in H1 despite domestic turmoil

Private equity activity has remained strong in a country experiencing turmoil brought about by terror attacks, labour law reforms and protests

Nordic buyout values soar amid high-liquidity environment

Average Nordic buyout values are growing, with the market expecting higher entry multiples and more leverage

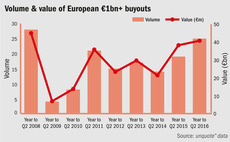

Southern Europe leads renaissance of billion-euro club

Dealflow in the тЌ1bn+ buyout segment reached an eight-year high across Europe in the 12 months to Q2 2016

Post-communist succession driving Czech dealflow

First generation of entrepreneurs that followed the fall of the Soviet Union look for new owners

Food tech: first warning signs as consolidation sets in

Deliveroo's $275m round shows the market remains frothy, but other recent news highlight the challenges facing startups and their VCs

Q2 Barometer: European buyout activity rebounds

European deal volume reached its highest total in six quarters, while aggregate value increased by 80% compared to Q1 levels

UK buyout activity continues apace despite Brexit vote

Activity figures for July would suggest that local private equity houses have not been deterred т with a few caveats

Deal in focus: IK sells Vemedia to Charterhouse Capital

Vendor's international buy-and-build strategy helped transform the Belgian pharmaceutical company into a pan-European force

The call of Africa: Exit focus

Comparatively longer holding periods and sales to PE buyers or strategic investors characterise the continent's current exit market

The call of Africa

unquote" takes an in-depth look into the emerging African private equity industry

International buyers swoop for low-hanging Brexit fruit

Devaluation of the pound has made UK assets attractive to non-sterling investors, though the opportunity may be short lived

Denmark increases share of Nordic PE deals

Southernmost Scandinavian country was the busiest country by deal volume in 2015

British private equity braces for post-Brexit uncertainty

While the effects on medium-to-long term dealflow are uncertain, the future of fundraising will be dependent on access to the single market