Investments

Russian Direct Investment Fund seeks partnership with Germany

State-backed Russian Direct Investment Fund (RDIF) is looking to form a strategic partnership for co-investments with Germany, according to reports.

TPG-backed retailer Republic enters administration

British clothing retailer Republic, owned by TPG Capital, has appointed Ernst & Young as its administrator.

E&Y: Corporates failing to look at PE as potential buyer

Only 3% of corporates surveyed by Ernst & Young for its latest Global Corporate Divestment Study believe private equity funds to be the most likely acquirer should they divest part of their business.

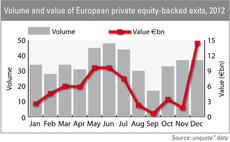

Exit market hits €15bn in December

Almost €15bn worth of capital was realised by private equity portfolio sales in December 2012, the highest amount in the past year, according to figures from unquote” data.

Vendors and banks amenable to strong 2013 in UK

Good signs for 2013

A happy New Year for venture capital?

Happy New Year

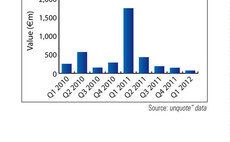

Q4 Barometer: European deal value up 82%

Q4 Barometer

Retail sector activity benefits from economic woes

The current economy has forced most retail businesses to rethink their strategy, leaving enough space for private equity firms to come in and get their share.

PE firms eye French gas storage business TIGF

Two bidder groups including AXA Private Equity and CDC Infrastructure have emerged in the sale of Total's gas storage unit Transports Infrastructures Gaz France (TIGF), according to reports.

Turkish snack chain hopes to raise $500m through PE

Turkish snack chain Simit Sarayi has entered negotiations with US investor Colony Capital and Dubai's Abraaj Capital for the sale of a minority stake in the business, according to reports.

CVC and RBS sell $290m stake in Samsonite

CVC Capital Partners and the Royal Bank of Scotland (RBS) have sold a $290m stake in Hong Kong-listed luggage brand Samsonite International, according to reports.

ADM Capital et al. looking to exit Turkish hospital

An investor group including ADM Capital, Dutch pension fund PGGM and the International Finance Corporation (IFC) are looking to exit Turkish hospital chain Universal Saglik Yatirimlari, according to reports.

One Equity Partners considers Turkish chem business

One Equity Partners and the Turkish army pension fund Oyak have been bidding to buy a stake in Turkish chemicals firm Akdeniz Kimya, according to reports.

Apollo negotiates stake in Aurum Holdings

Apollo Global Management has shown interest in acquiring a stake in British jewellery company Aurum Holdings, according to The Telegraph.

Herkules Capital's Pronova BioPharma receives takeover bid

Herkules Capital's Norwegian portfolio company Pronova BioPharma has received a voluntary cash offer from German chemicals company BASF SE.

Nomura targets PE-like returns with new index

Nomura and QES (Quantitative Equity Strategies) have launched the daily investible long-only index PERI (Modelled Private Equity Returns Index).

Blackstone and Anacap set up joint venture for financial assets

The Blackstone Group and Anacap Financial Partners have set up a joint venture to buy European financial assets.

Can social capital convince investors?

Prime Minister David Cameronтs much vaunted тBig Societyт project finally got off the ground this month with government-established investor Big Society Capital (BSC) making its first commitments.

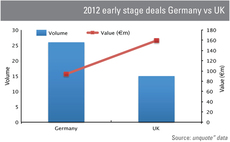

Early-stage investments: German deal volume booms

While German early-stage activity has risen in volume in the first half of 2012, the UK holds its own with strong overall deal value.

PE players cashing in on energy services consolidation

Environmental, social and governance (ESG) issues are becoming more important to businesses, leading to the emergence of intense private equity interest in the energy management services sector. Research by Robert W Baird suggests an increase in deal...

CEE activity: bottomed out?

Next weekтs CEE unquoteт Congress will reveal reader sentiment for CEE prospects.

KKR buys nursing home debt

KKR has purchased part of the loans of UK nursing home operator Four Seasons Health Care Group Ltd.

LP caution hits life science investments

Universities can be a safe environment to raise funds and develop ideas. But it looks like university clusters are losing their pull factors in the eye of diminishing returns to investors. Anneken Tappe investigates