Industry

GPs feel heat as LPs raise fund contribution expectations

LPs are increasingly expecting GPs to make a 2% contribution to their next fund, putting pressure on investment professionals to earn carry, according to an Investec survey.

CVC places Evonik shares as IPO markets wake up

CVC is the latest GP taking a more flexible approach to exiting its businesses, selling a share in chemicals business Evonik to institutional investors in preparation for an IPO.

Carlyle earnings disappoint

Carlyle Group's economic net income has declined by 28% compared to last year, causing its share price to fall by almost 8%.

Nordic Capital's eighth fund holds first close

Nordic Capital has held a first close on тЌ1.7bn for its latest fund, exceeding its expected тЌ1.5bn first-close target.

Italy shines in January thanks to CVC mega-buyout

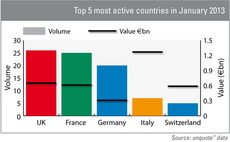

Italy topped Europe's private equity value charts in January, while the UK recorded the most deals, showing both familiar names and outliers starting 2013 on a high.

Austrian private equity market gathers momentum

Austria’s private equity scene could be on the verge of a mini-boom as January’s deal activity has already outperformed last year’s first quarter.

Ratos made SEK 363m loss in Q4

Ratos made a net loss of SEK 363m in the fourth quarter of 2012 and expects the downwards trend to continue during the first half of 2013.

Private equity's biggest scandals

Public image

SVG banishes the ghosts of the past

Just a year ago, things were looking very bleak for fund-of-funds manager SVG, but yesterday’s announcement of a new partnership with Aberdeen Asset Management has given the firm new reasons to be optimistic about its future.

SVG Capital injects €100m into Cinven

Listed investment trust SVG Capital has committed тЌ100m to the latest fund managed by London-based GP Cinven.

Aberdeen acquires majority stake in SVG Advisers

Aberdeen Asset Management has acquired a 50.1% stake in SVG Capital subsidiary SVG Advisers (SVGA) for ТЃ17.5m.

BVCA calls for return of taper relief

The BVCA has called for the return of the controversial taper relief for capital gains tax (CGT) in some cases.

TPG-backed retailer Republic enters administration

British clothing retailer Republic, owned by TPG Capital, has appointed Ernst & Young as its administrator.

ESMA publishes remuneration guidelines

The European Securities and Markets Authority (ESMA) has published guidelines for the remuneration of senior employees in alternative investment funds.

Financial rewards still main incentive for chairmen of PE-backed businesses

The potential of a significant pay-out on exit is still the main incentive for working with private equity-backed businesses, according to a recent survey of 502 UK-based chairmen and non-executive directors (NEDs).

E&Y: Corporates failing to look at PE as potential buyer

Only 3% of corporates surveyed by Ernst & Young for its latest Global Corporate Divestment Study believe private equity funds to be the most likely acquirer should they divest part of their business.

Doughty Hanson refocuses on private equity

Doughty Hanson has completed its internal restructuring, moving away from real estate and venture, alongside the creation of a new partnership structure.

CapMan to hire new CEO

CapManтs board of directors has started a search process to replace its current CEO Lennart Simonsen, who is resigning from his position as part of the firmтs development programme.

Finding a way to exit the boom year deals

Many of the headline-hitting buyouts of the boom era are still sitting in private equity portfolios. Charles Magnay, partner at Altius Associates, looks at how GPs have adapted to exit large companies in the post-Lehman world.

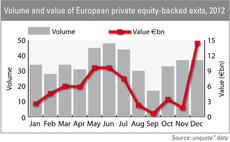

Exit market hits €15bn in December

Almost €15bn worth of capital was realised by private equity portfolio sales in December 2012, the highest amount in the past year, according to figures from unquote” data.

Latest unquote" available on iPad

unquote" on iPad

Vendors and banks amenable to strong 2013 in UK

Good signs for 2013

New German GP Rantum Capital targets mid-market

A group of German businessmen, including former Morgan Stanley Germany CEO Dirk Notheis, have founded a new private equity firm named Rantum Capital.

PE backers to reduce NXP Semiconductors stakes

AlpInvest Partners, Apax Partners, Bain Capital Partners, KKR and Silver Lake Technology Management are due to sell 30 million shares in listed Dutch semiconductor developer NXP Semiconductors.