Industry

VC Profile: Edge Investments

As the firm begins raising its second fund, chief IR officer David Fisher discusses the current portfolio, LP sentiment and the creative economy

2011-vintage funds: what is still in Nordic portfolios

Unquote and Mergermarket round up a selection of assets still held in 2011-vintage funds managed by Nordic GPs

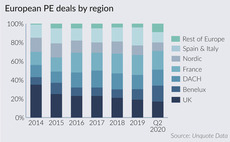

PE exits hit decade low in Q2

Volume of exits by PE players across Europe fell by 43% year-on-year in Q2 2020 as the coronavirus crisis took hold, according to Unquote Data

PE secondaries volume cut by more than half in H1 - survey

Private debt fund secondaries were hit even harder with an 81.8% plunge, Setter says

GP Profile: Emeram Capital Partners

DACH-focused GP anticipates the launch of its second fund following a portfolio assessment and digital AGM

Apax VIII and Apax IX post higher valuations than Q4 2019

Both funds have valuations of more than 14% higher compared with valuations in March 2020

Virtual Briefing: ESG and rebalancing through secondaries

Palico's Woolston Commons, Cambridge Associates' Varco and Unigestion's Newsome discuss whether the current crisis will lead to an ESG rethink

HV Holtzbrinck promotes Masemann to partner

Jasper Masemann joined the VC firm in 2015 and specialises in software and AI investments

Campbell Lutyens promotes Patel to partner

Placement agent has also promoted Vincent Ragosta to principal in its New York office

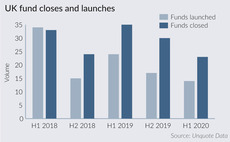

UK fundraising update: pausing for breath

A number of GPs that closed more than three years ago have delayed fresh fundraises, or have altogether decided to explore new options

Roland Berger makes three DACH hires

Stephan Hartmann, Jan Maser and Markus Held join the firm's restructuring and debt advisory services

Silverfleet hires Süß as partner

Süß joins Silverfleet's DACH-focused team from TowerBrook Capital Partners

Willkie hires Abrar as partner

Kamyar Abrar joins from Weil Gotshal & Manges' PE team and also has experience in corporate deals

GP Profile: Priveq Investment

Sweden-based GP completed fundraising for its sixth fund entirely online

Aurelius's Zim Flugsitz in self administration

Aurelius intends to make contributions to the airline seat producer's proposed restructuring

Market sentiment improving but dealflow likely to remain bifurcated – Baird

Baird MDs Vinay Ghai and Paul Bail discuss deal-making amid the pandemic and emerging trends for the months ahead

EQT to close ninth buyout fund in Q3

Total investments by the EQT funds in the second quarter amount to тЌ1.3bn

LP platform Titanbay launches

Titanbay has a 1% set up fee for clients and a 0.5% annual maintenance fee

Fund Profile: Ardian Secondary Fund VIII

Ardian discusses with Unquote its secondaries activity and outlook on market trends amid the pandemic

Mercia invested £17.5m in 2019/20

Mercia's NVM VCTs raised ТЃ38.2m in new capital, while the BBB also allocated an additional ТЃ54.3m

LDC's makes 18 investments in H1 2020

In a half-year update, the firm announced the majority of the deals were completed since March

Unquote Private Equity Podcast: Fundraising engine stalls

This week, the Unquote Podcast examines the fundraising market amid the challenges of Covid-19

HIG hires Meysson as head of European direct lending

Pascal Meysson joins from Alcentra and has previous experience at Deutsche Bank and Charterhouse

Capgemini to help Nordic Capital implement AI for portfolio companies

GP said one of its portfolio companies already using machine learning to generate additional revenues