Benelux

Could mega fundraisings cause Nordic dry powder problem?

International investors have driven Nordic fundraising to unprecedented levels, but will deal flow keep up with the dry powder? Sonnie Ehrendal investigates.

Dechert opens in Frankfurt; poaches Mayer Brown partner

Private equity specialist Dr. Benedikt Weiser will join Dechert next month from Mayer Brown, where he was head of the firmтs German Private Investment Funds group.

Waterland PE backs Omega Pharma take-private

Waterland Private Equity has backed the take private of over-the-counter pharmaceuticals company Omega Pharma.

unquote" private equity barometer - Q3 2011

Deal activity levels fell by more than a third in Q3 2011 due to ongoing fears regarding the European debt crisis, according to the latest unquoteт Private Equity Barometer, in association with Arle Capital Partners.

DN highlights venture revival

Six exits in 18 months; two portfolio companies bought by Oracle in 2011 alone. One firm is living the dream. Kimberly Romaine reports.

Prime Ventures invests €13m in takeaway

Prime Ventures has backed online company takeaway.com in a €13m funding round.

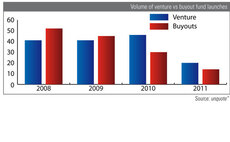

Volume of buyout vs venture fund launches

In 2010, launches of venture funds surpassed buyout funds for the first time in 5 years, but the gap has narrowed in 2011.

Access Capital Partners closes fund on €500m

Access Capital Partners has held a final close of its fifth European small- and mid-market fund-of-funds, Access Capital Fund V Growth Buy-out Europe (ACF V), on тЌ500m т above its initial target of тЌ350m.

IK Investment Partners hit by carried interest row

The Swedish tax authority's battle over carried interest taxation continues as another player is drawn into the feud. Sonnie Ehrendal investigates.

Summit Partners holds final closing of venture fund on $520m

Summit Partners has announced the final closing of the Summit Partners Venture Capital Fund III on $520m.

Summit Partners' eighth fund closes on $2.7bn

Summit Partners has announced the final closing of Summit Partners Growth Equity Fund VIII on $2.7bn.

Gimv increases majority stake in VCST

Gimv has acquired LRM's stake in VCST and increased its majority holding to 79.8% of the company.

Italian sentiment: fundraising, leverage largest challenges

A recovery for the Italian market is not expected until 2013 at the earliest, according to a recent poll - but the backdrop brings with it fresh prospects.

Merry Christmas from the unquote" team

At the end of this busy year for the private equity industry, the unquoteт team wishes all our readers a merry Christmas a happy New Year.

Top 5 buyout investors 2011

Bridgepoint Capital leads unquote"тs list of the top 5 buyout investors of the year, with 10 completed deals.

The year that was 2011: Spinouts and technocrats

The past year has been perhaps the most turbulent since the financial crisis hit. While there has been plenty of activity and a return of large deals, the Eurozone crisis has certainly had an impact.

Carlyle acquires The Sniffers

The Carlyle Group has acquired a majority stake in the Belgian emission monitoring company The Sniffers.

The year that was 2011: Funds launch amid Eurozone crisis

The past year has been perhaps the most turbulent since the financial crisis hit. While there has been plenty of activity and a return of large deals, the Eurozone crisis has certainly had an impact.

The year that was 2011: Mega-deals and key man clauses

The past year has been perhaps the most turbulent since the financial crisis hit. While there has been plenty of activity and a return of large deals, the Eurozone crisis has certainly had an impact.

The year that was 2011: EMI saga ends, ISS woes continue

The past year has been perhaps the most turbulent since the financial crisis hit. While there has been plenty of activity and a return of large deals, the Eurozone crisis has certainly had an impact.

Rumour roundup: what to expect in 2012

With 2012 just around the corner, the market is abuzz with rumours. Sonnie Ehrendal takes a look at what to expect in the coming year.

Van den Ende & Deitmers acquires 30% of QUADIA

Van den Ende & Deitmers has acquired a 30% stake in online video provider QUADIA.

Leverage in 2012: liquidity still a concern

The latter months of 2011 have been characterised by diminishing liquidity and a great deal of volatility in financial markets, and it is these two interplaying factors that will perform the most significant role in shaping the year to come.

Apollo acquires Taminco for €1.1bn

Apollo Global Management has acquired chemical company Taminco from CVC for about €1.2bn.