Benelux

Wellington Hadley Harbor III closes on $1.8bn

In addition to the capital raised, the fund also has access to up to $400m from co-investors

Forbion V closes on €460m hard-cap

Investors in Forbion V include a mix of existing and new LPs including Pantheon and Argentum

Scale Venture Partners Fund VII closes on $600m

Fund targets software startups, with a special focus on cloud infrastructure, cybersecurity and AI

Permira leads €150m round for Catawiki

Accel also backs the round for the Netherlands-based online auction platform

Gimv sells Climate for Life to Parcom

Gimv formed the climate control business in 2016 by merging Itho Daalderop and Klimaatgarant

Ace Management leads €20m series-C for EclecticIQ

Company plans to use the fresh capital to scale up its teams and further expand internationally

TriSpan Opportunities Fund II holds first close

Fund focuses on investment opportunities in the lower-mid-market across North America and Europe

ProFounders leads €4.1m series-A for Nodalview

Company intends to use the fresh capital to scale up its team, while boosting its growth and expansion

VCs in €3.5m round for Cumul.io

Stijn Christiaens, co-founder and CTO at Collibra, will continue to act as an independent board member

SR One set to deploy $500m fund following GSK spin-out

CEO Simeon George tells Unquote that the firm is seeing early-stage and later-stage opportunities

Andreessen Horowitz raises $4.5bn across two funds

VC raises $1.3bn for its seventh early-stage fund and $3.2bn for its second growth fund

HIG Europe Capital Partners III closes on €1.1bn

Fund invests in buyouts, recapitalisations and corporate carve-outs of European businesses

GSK spinout SR One closes $500m debut fund

Biotechnology-focused vehicle will invest in Europe and the US, with GSK as cornerstone investor

Astanor Ventures I closes on $325m

One family office from Asia has invested in the fund, but the majority are based in Europe and the US

Multiples Heatmap: average entry multiple hits 10.5x as dealflow recovers

The UK and Ireland was the hottest region for multiples in Q3, also seeing the largest increase in valuations of any region

Novalis Biotech aims for January second close for new €25m fund

Belgian VC Novalis held a first close on €8m for its second fund on 8 November

Covid-19, oversubscribed funds fuel interest in early secondaries

Early secondaries are tipped to become more plentiful in the coming months, but market observers urge caution to mitigate potential pitfalls

Newion leads €2m for Objective Platform

Newion III's objective is to invest in companies in the business technology and software sectors

Speedinvest holds first close for Speedinvest x Fund 2

VC also announced the appointment of Tier Mobilty co-founder Julian Blessin as partner

IK buys majority stake in GeoDynamics from Sofindev

Sofindev had reportedly been looking to sell its 50.1% in the company and had mandated EY for the process

Värde Dislocation Fund closes on $1.6bn

Fund has a global mandate to pursue a mispriced, stressed and distressed credit

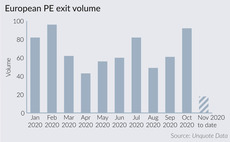

Private equity ramps up divestment efforts

Exit activity jumped by 50% in October, back to pre-pandemic levels, according to Unquote Data

Buyout rankings: who has invested most across Europe since April?

EQT, Ardian and KKR remained very active and struck sizeable deals amid the coronavirus turmoil

Mutares carves out two units from Gea Group

Deal includes the companies' sites located in France and the Netherlands, with a total of 230 employees