Benelux

Bregal Milestone to launch Anywhere365 sale in Q1 2023

Lazard to advise on auction for Dutch cloud-based contact centre and dialogue-management platform

MML launches lower-mid-market strategy for UK, Northern European B2B assets

London-headquartered GP invested in AI provider MIcompany in first deal for new strategy this week

Integra Partners heads for year-end close for EUR 250m second fund

Vehicle is open to retail investors with tickets of EUR 500,000-plus and will make fund and co-investments

GP Profile: Armen eyes "new frontier" for GP stakes in Europe

France-headquartered GP stakes investor is seeking to support sponsors as they become multi-strategy managers, co-founder Dominique Gaillard tells Unquote

IPEM 2023: GPs battle fundraising blues on the Côte d'Azur

Sponsors remain broadly optimistic despite fundraise bottlenecks and a growing number of LPs faced with tough choices on manager selection

The Bolt-Ons Digest – 26 January 2023

Unquoteтs selection of the latest add-ons, with ICG's Circet, Five Arrows' Mintec, Carlyle's Jagex, and more

Q4 Barometer: deal count remains steady amid tough environment

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

Flight to quality, impact investing to drive allocations in 2023 – HarbourVest

Asset managerтs investment team discusses secondaries and co-investment dynamics amid a challenging fundraising market

Unquote Private Equity Podcast: The PE auction in times of exit scarcity

Rachel Lewis joins Harriet Matthews to discuss how auction process dynamics are changing against the current market backdrop

Arcano holds EUR 450m final close for latest secondaries fund

With just under 50% deployed, the vehicle will split focus evenly between LP stakes and GP-leds

Waterland raises EUR 4bn for buyout and minority funds

Flagship fund closed EUR 1bn above predecessor amid a tough fundraising environment for midcap GPs

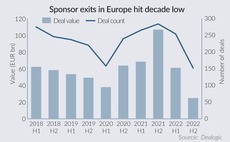

Going, going, not gone: PE auctions bid for relevance amid risk-off environment

With a debt financing drought and macro woes denting exits, GPs are adapting the traditional M&A auction in favour of more flexible bilateral negotiations to get deals across the line

Bellevue eyes Q1 2023 first close for debut secondaries fund

With USD 200m target, vehicle will primarily focus on USD 1m-30m LP stake deals

Partners Group sets fundraising guidance at USD 17bn-22bn

Private markets investor finished 2022 at the bottom of USD 22bn-26bn target for new commitments

Dyal raises USD 12.9bn for new fund with CVC, PAI stakes in portfolio

Blue Owlтs division exceeded target for fifth fund specialised in buying minority stakes in asset managers

Bregal Sagemount invests in Enhesa in third deal from new fund

Deal sees ICG exit minority stake in regulatory and sustainability intelligence group; CGE retains control

Hamilton Lane raises USD 2.1bn for fifth co-investment fund

Close comes at a time when challenging credit and fundraising markets are increasing GPsт need for strategic capital sources

Equistone acquires BUKO Infrasupport and BUKO Waakt

Scheybeeck family office partially exits Dutch traffic and safety management businesses

Rede Partners opens Amsterdam office

Private capital adviser aims to grow its European footprint with first office on the continent

General Atlantic holds USD 2.6bn final close for debut climate fund

BeyondNetZero strategy has USD 3.5bn to deploy in total with additional firepower from the GP

Unquote Private Equity Podcast: 2023 - New year, new market?

Unquote and Mergermarketтs private equity reporting team discuss the past 12 months and what lies ahead next year

Private Equity Trendspotter: Sponsors look for sure footing as market slowdown signals change in deals landscape

Aggregate buyout volume brings 2022 just 6% above pre-pandemic dealmaking, with a significant sentiment shift in H2 2022

Munich Private Equity closes Fund IV on EUR 392m

Fund-of-funds investor will split deployment evenly between Europe and North America

Clearwater Multiples Heatmap: Valuations ease as PE deals slow down

After a record quarter, Q3 2022 sees sponsor transactions fall sharply amid challenging macro environment