Benelux

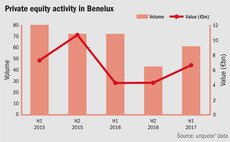

Benelux activity picks up in first half of 2017

Following a slow H2 in 2016, dealflow in the Benelux region is on the up with Belgium in particular seeing increasing activity

Politics and private equity – the revolving doors

FranУЇois Fillon is the latest in a long line of politicians to make the move to private equity

Aerospace investments taking off for PE

As evidenced by the recent VistaJet and Pattonair deals, PE is increasingly looking at the aviation and aerospace sectors for opportunities

AlpInvest hires Bagijn as primaries business head

New managing director is joining from her previous role at Axa Investment Managers

Halder-backed Aqua Vital buys Kalimba

Acquisition solves a succession problem for the company's founders, who started the business in 1996

Mentha mulling Optimum sale

Mentha Capital took a majority stake in Optimum in 2014, investing from Mentha Capital Fund IV

Mentha Capital exits Venko Groep

Mentha sells the Dutch business to Clayton Dubilier & Rice portfolio company BrandSafway

Onex raises $5.72bn for fifth fund after four months

Canadian-based GP is targeting $6.5bn for the vehicle, which launched in April 2017

Q2 Barometer: Aggregate PE deal value reaches 10-year peak

Deal numbers climbed for the second consecutive quarter, boosted by buyouts and growth capital deals

Goodwin promotes Luxembourg specialist in London funds practice

Alexandrine Armstrong-Cerfontaine joins Goodwinтs PE and funds practice as a partner in London

Main Mezzanine backs MBO of Fairbanks

Company management took the majority stake and Rabobank provided senior debt for the buyout

Gilde backs MBO of Albelli

GP will draw capital from its €1.1bn fund V, which held a final close in November 2015

Triton buys Unica

Management and the van Vliet family will hold 49% of the new company, while Triton will take 51%

PAI Partners mulls €4bn fund launch by year-end

GP plans a quick return to the fundraising trail, following a busy 24 months in the wake of its previous close

Summit holds €700m final close for second growth equity fund

GP held an interim close for the vehicle, Summit Partners Europe Growth Equity Fund II, on тЌ600m in May 2017

Mangrove holds first close on $170m for fifth VC fund

VC will target European technology companies in the early stages of development, with add-on capital available

Ergon Capital acquires Keesing from Telegraaf for €150m

Ergon is investing through the €350m buyout vehicle Ergon Capital III, closed in 2010

Main Mezzanine backs DMP

Main provided a mezzanine loan and took a minority stake alongside management

Carlyle acquires ADB Safegate from PAI Partners

Carlyle is investing from its €3.75bn mid-market vehicle Carlyle Europe Partners IV, closed in 2015

VEP buys Scheuten Glass

Acquisition solves a succession issue with the company's 69 year-old founder, according to the GP

Mentha Capital buys drilling equipment maker Brownline

Deal follows the recent €143m final close of the GP's fifth vehicle in January 2017

HarbourVest closes co-investment fund on $1.75bn hard-cap

GP increases original hard-cap for fourth co-investment offering due to LP demand

Star Capital closes latest fund on €800m

Fund closed on its hard-cap and has already been put to work for two investments

Stapled secondaries moving upmarket

BC becomes the latest firm to benefit from a stapled secondaries deal, as some industry insiders anticipate a developing trend