Benelux

Index Ventures leads $24m round for Elasticsearch

Index Ventures, Benchmark Capital and new investor SV Angel have backed Dutch data analytics company Elasticsearch with a $24m series-B round of funding.

Orix buys Robeco for €1.9bn

Japanese financial services firm Orix has bought the asset management arm of Rabobank, Robeco, for €1.935bn.

Apollo's Taminco considers IPO in US

Apollo Global Management portfolio company Taminco Global Chemical, a Belgian chemical business, is understood to be considering a US flotation.

Orix Corporation looking to buy Robeco

Japanese financial services firm Orix has confirmed that it is considering buying the asset management arm of Rabobank for up to €2bn.

Van Campen Liem opens Luxembourg office

Dutch law firm Van Campen Liem has announced the opening of its Luxembourg office.

Vendis Capital backs Hypo Wholesale

Vendis Capital has taken a majority stake in Dutch equestrian equipment wholesaler Hypo Wholesale.

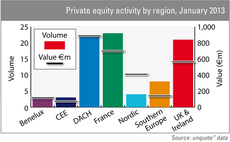

UK activity falls behind France and DACH

The UK & Ireland private equity market has been overtaken by the French and DACH regions in January according to figures from unquoteт data.

Arle's Innovia acquires additional 50% in Securency

Arle Capital Partners' UK chemical company Innovia Films has acquired the remaining 50% stake in joint venture Securency International from the Reserve Bank of Australia (RBA).

TIIN Capital invests in Olery

TIIN Capital has invested in Dutch hotel reputation management business Olery.

TIIN's ReadSpeaker completes management buy-back

TIIN Capital has sold its stake in Dutch software-as-a-service company ReadSpeaker back to the firm's management.

Gimv et al. invest €5.5m in pharma company Multiplicom

Gimv and regional Belgian players have invested €5.5m in Antwerp-based biotechnology company Multiplicom NV.

Benelux unquote" February 2013

The Dutch venture capital industry has suffered a lot in the past couple of years. While the country’s early-stage sector was growing until 2008, it collapsed entirely in 2009. Since then, dealflow has been slow. According to unquote” data, Dutch venture...

KKR and Bayside Capital acquire 75% of Estro Group

KKR and Bayside Capital, the credit business of HIG, have acquired 75% of Dutch day-care operator Estro Group as part of the company's restructuring.

PE backers to reduce NXP Semiconductors stakes

AlpInvest Partners, Apax Partners, Bain Capital Partners, KKR and Silver Lake Technology Management are due to sell 30 million shares in listed Dutch semiconductor developer NXP Semiconductors.

Summit Partners sells Ogone to Ingenico for €360m

Summit Partners has exited Belgian payment solutions provider Ogone in a €360m trade sale to listed company Ingenico.

CVC to lead €1.8bn restructuring of SNS Reaal

CVC Capital Partners will lead a consortium to restructure SNS Reaal, a Dutch insurer and the country's fourth largest bank, according to local press.

Omnes Capital et al. invest in Medisse

IIG (Innovatie- en Investeringsfonds Gelderland), BioGeneration Ventures and Omnes Capital have invested €2.6m in Dutch pharmaceuticals company Medisse.

Enterprise Investors to acquire Scitec Holding BV

Enterprise Investors has acquired a significant majority stake in international sports nutrition company Scitec Holding BV, together with its minority co-investor Morgan Stanley Alternative Investment Partners.

Nausicaa Ventures et al. invest €7.7m in Bone Therapeutics

Existing investors and two new regional backers have committed €7.7m to Belgian pharmaceuticals company Bone Therapeutics.

Indufin takes 40% stake in SecureLink

Indufin has acquired a 40% stake in Belgian IT networking and security solutions provider SecureLink.

Unilever and FF&P exit BAC BV

Unilever Ventures and FF&P Private Equity have sold BAC BV, which specialises in affinity purification of biological materials, to Life Technologies Corporation.

Prime Ventures IV holds first close on €100m

Prime Ventures has held a first closing for its latest fund, Prime Ventures IV, on €100m.

Benelux private equity's 2012 highlights

The Benelux region had a relatively quiet 2012 and little deal activity is expected until the broader European economy improves. However, the deal dearth was eclipsed by other events, including the clean-up of Belgium’s banking sector, the Dutch elections...