CEE

Covid-19, oversubscribed funds fuel interest in early secondaries

Early secondaries are tipped to become more plentiful in the coming months, but market observers urge caution to mitigate potential pitfalls

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Speedinvest holds first close for Speedinvest x Fund 2

VC also announced the appointment of Tier Mobilty co-founder Julian Blessin as partner

Innova acquires stake in Bielenda Kosmetyki

Proceeds from the investment will fund the company's acquisition of two cosmetics brands from Norwegian cosmetics group Orkla

Värde Dislocation Fund closes on $1.6bn

Fund has a global mandate to pursue a mispriced, stressed and distressed credit

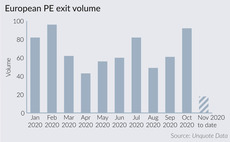

Private equity ramps up divestment efforts

Exit activity jumped by 50% in October, back to pre-pandemic levels, according to Unquote Data

Buyout rankings: who has invested most across Europe since April?

EQT, Ardian and KKR remained very active and struck sizeable deals amid the coronavirus turmoil

FirstFloor et al. back €41m series-D for Skeleton

Latest round brings Skeleton's total funding to €93m since its inception in 2009

Mid Europa buys Polish e-retailer Displate

Company's founders will remain significant minority shareholders of the business

Preparing for the turnarounds wave

The much-anticipated wave of distressed opportunities has failed to materialise so far, but market participants are still readying for an uptick

Sponsor-lender relationship faces stiff Covid-19 test

GPs' relationships with their existing banks and debt funds will remain key to managing the ongoing consequences of the crisis

Secondaries update: Unigestion's David Swanson

Secondaries activity is recovering from the initial coronavirus-related shock, with good prospects for GP-led secondaries deals

Blackstone Core Equity Partners II closes on $8bn

BCEP II follows a long-hold private equity strategy, with an investment period of 15 years

TVM Capital closes LSI II on $478m

Vehicle is TVM's largest ever fund and the second in its exclusively life-sciences-focused strategy

Digital doctors here to stay as telemedicine deals surge

Rise in demand for telemedicine т and promising returns for investors that have been targeting the space т looks set to continue

Abris exits locomotive leasing business Cargounit to Three Seas

Polish buyout firm Abris Capital Partners has signed an agreement to sell its stake in Polish locomotive lessor Cargounit, also known as Industrial Division, to Three Seas Investment Fund (3SIIF).

Amplify raises $375m across two funds

Amplify IV targets seed and series-A rounds, while Amplify Select makes follow-on investments in existing portfolio companies

Innova to buy PayPoint's Romanian division

PayPoint will use the proceeds to focus on core UK markets

European Direct Lending Perspectives Q2 2020

Debtwire and Creditflux examine the way direct lenders reacted to pandemic-related upheaval and how the industry looks set to bounce back

Lithuanian Aid Fund for Business looks to raise up to €500m

Fund has already secured a €100m investment from the Lithuanian government

True Ventures raises $840m in two final closes

True Core VII provides seed and early-stage capital, while True Select IV provides follow-on capital

Mid Europa sells minority stake in listed Waberer's

Transaction also includes a call option for trade buyer Indotek for the GP's remaining 47.99% stake

Enterprise Investors buys remaining stake in Pan-Pek

GP has acquired the remaining 35% in the company, having bought a 65% stake in the company in May 2018

Levine Leichtman Capital Partners Europe II closes on €463m

Fund has already completed one investment and has two additional deals under contract