CEE

Unquote Private Equity Podcast: The PE auction in times of exit scarcity

Rachel Lewis joins Harriet Matthews to discuss how auction process dynamics are changing against the current market backdrop

Presto Ventures targets EUR 100m for new early-stage fund

Czech VC seeks to attract larger institutional investors from Western Europe and US for its third vehicle

Merito Partners targets EUR 50m for debut growth equity fund

Sponsor plans to build a portfolio of 12-18 companies, with EUR 12m in fund commitments secured to date

Going, going, not gone: PE auctions bid for relevance amid risk-off environment

With a debt financing drought and macro woes denting exits, GPs are adapting the traditional M&A auction in favour of more flexible bilateral negotiations to get deals across the line

Aper Ventures explores EUR 30m-plus fund launch in 2024

Polish VC’s third vehicle will seek capital from local state development fund and business angels

Zero One Hundred targets EUR 15m for new fund's first close

Slovakian GP seeks institutional investors, corporates and sovereign funds for EUR 60m vehicle

Women in VC: FundingBox.vc's Cymerman on new fund plans and the power of networking

Deep tech investor could look to raise EUR 50m-plus for its next vehicle, co-founder Iwona Cymerman tells Unquote

Practica Capital aims for EUR 80m hard-cap for third fund

Lithuanian VC investor could hold second and final close in May or June next year

Unquote Private Equity Podcast: 2023 - New year, new market?

Unquote and Mergermarketтs private equity reporting team discuss the past 12 months and what lies ahead next year

Private Equity Trendspotter: Sponsors look for sure footing as market slowdown signals change in deals landscape

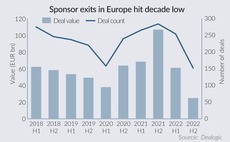

Aggregate buyout volume brings 2022 just 6% above pre-pandemic dealmaking, with a significant sentiment shift in H2 2022

Clearwater Multiples Heatmap: Valuations ease as PE deals slow down

After a record quarter, Q3 2022 sees sponsor transactions fall sharply amid challenging macro environment

The Bolt-Ons Digest – 14 December 2022

Unquoteтs selection of the latest add-ons, including CVC's Stark Group, Bridgepoint's Kereis, EQT's Open Systems, and more

Large LPs among most concerned about denominator effect – Coller Capital

As the stock market slump slows down their PE commitments, LPs are set to increase use of the secondaries market to balance allocations

Thein to raise EUR 45m to boost IT and engineering funds

Czech sponsor aims to attract institutional investors and HNWI to its two vehicles

H2 turns to bilateral talks to get Optegra sale over the line, sources say

Deal with MidEuropa sealed after auction for ophthalmology group went quiet earlier this month

MidEuropa takes majority stake in Optegra

H2 Equity reinvests with minority share; sale saw interest from Partners, HIG, CapVest

INVENIO on the market for Southeast Europe-focused growth fund

With EUR 75m target, vehicle has the EIF and two Bulgarian pension funds among its LPs

Sponsors ponder ESG questions as EU Taxonomy spurs gas, nuclear funding flow hopes

Framework gives green light to deals in the sector but LP accountability could stymie potential investments

PE liquidity at all time low amid macro woes – Rede Partners

Gabrielle Joseph speaks to Unquote about what the latest Rede Liquidity Index reveals about the 2023 fundraising market

Fundraising power balance shifts to LPs – panel

Panellists at SuperInvestor conference in Amsterdam discuss how GPs can grab LPsт attention in a challenging market

Final close: Sponsors fight through buyout fundraising drought

With EUR 100.5bn in commitments this year, European buyout fundraising is likely to be the lowest since 2018

Q3 Barometer: M&A softens across entire PE spectrum

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

212.vc sets EUR 90m hard-cap for third fund

B2B tech-focused VC firm expects to reach a EUR 30m-40m first close for the fund by the end of Q1 2023

Adams Street raises USD 1.3bn for Co-Investment Fund V

Global strategy surpassed its USD 1bn target and will invest with buyout and growth equity GPs